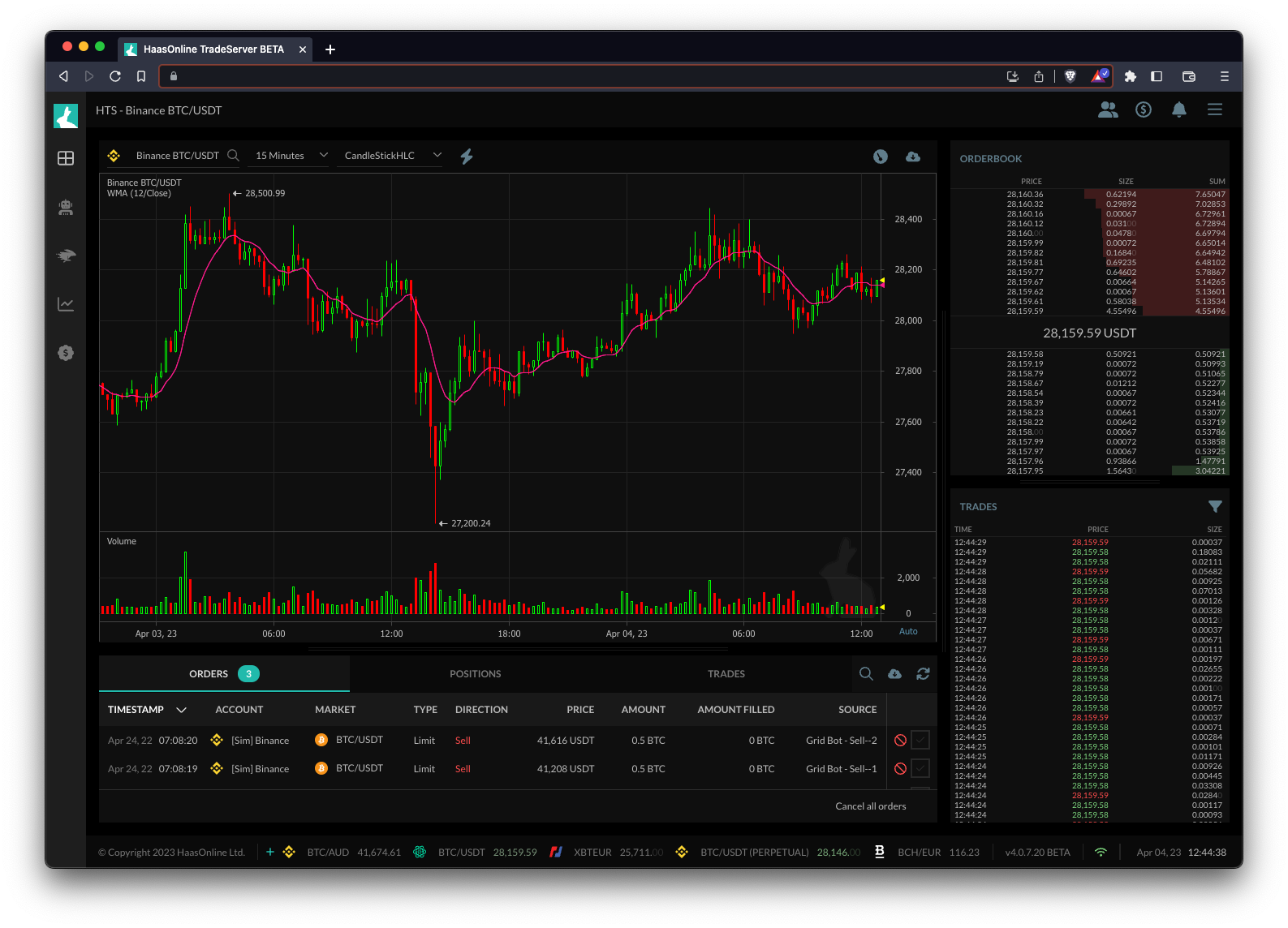

Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) technical indicator is a type of moving average that assigns weights to the prices in the data series being analyzed. The weights assigned to the prices in the series decrease linearly, which means that the most recent prices are given greater weight compared to earlier prices.

In trading bots like HaasOnline, the WMA is used as a trend-following indicator. It helps traders identify the direction of a trend by smoothing out price fluctuations over a specific period. Traders can use the WMA to generate buy or sell signals when the price crosses above or below the moving average line.

One way to use the WMA with HaasOnline is to create a strategy that combines it with other indicators to generate a more reliable signal. For example, a trader could use the WMA in combination with the Relative Strength IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... (RSI) to generate a buy signal when the price is trending up and the RSI is below a certain level.

Overall, the WMA is a useful tool for traders looking to identify trends in the market and make informed trading decisions.