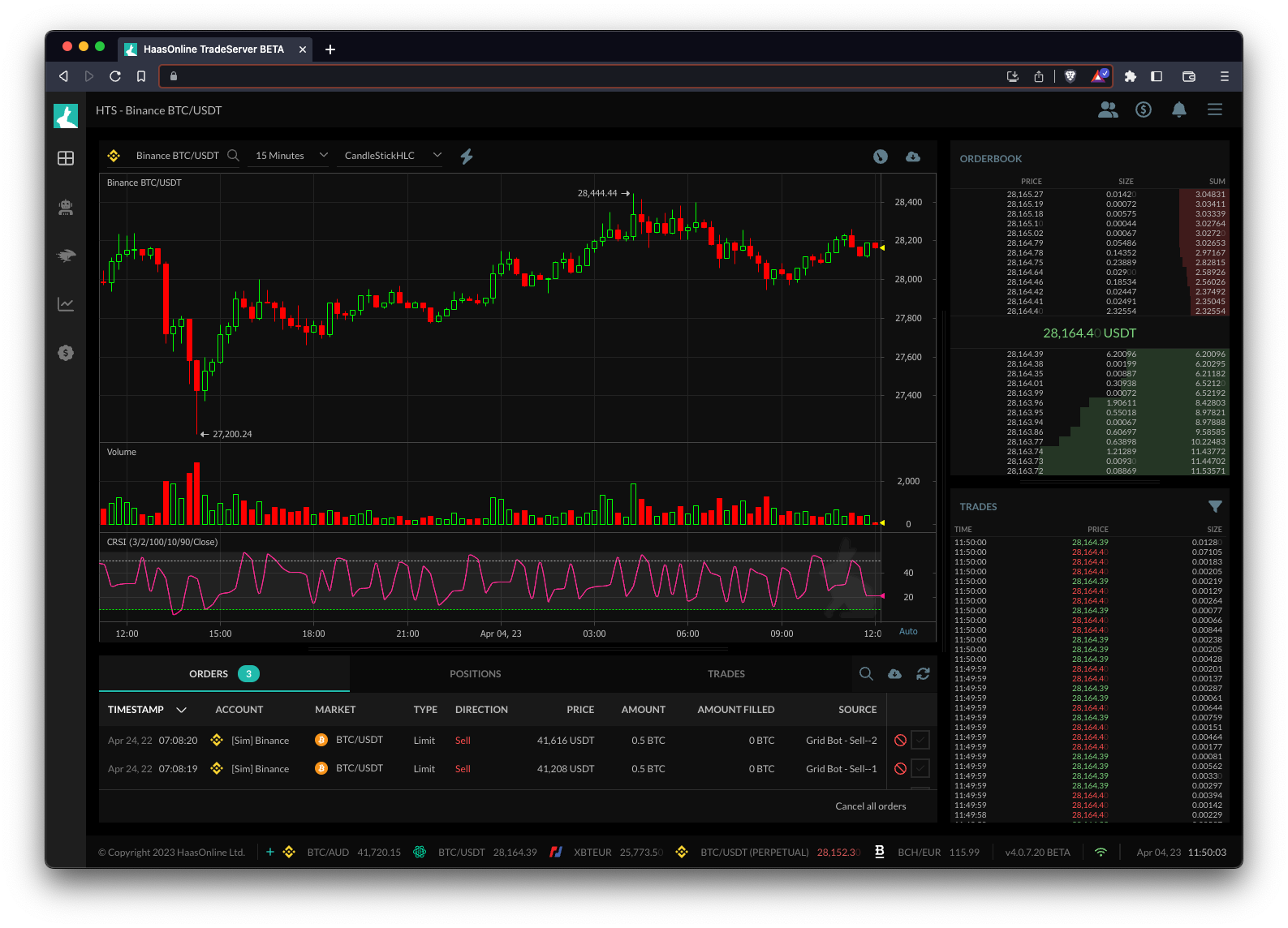

Conners RSI

The Connors RSI is a technical indicator developed by Larry Connors and it is a composite indicator consisting of three components: the RSI, the up/down length and magnitude.

The RSI component of the indicator measures the magnitude of recent price changes, the up/down length component measures the length of the recent price changes, and the up/down magnitude component measures the strength of the recent price changes.

The Connors RSI can be used by trading bots like HaasOnline to identify overbought and oversold conditions in the market. When the indicator is above 70, it is considered overbought and when it is below 30, it is considered oversold. Traders can use this information to enter or exit trades.

Additionally, the Connors RSI can be used to identify divergences between the indicator and the price of the asset being traded. A divergence occurs when the price of the asset and the indicator are moving in opposite directions. Traders can use this information to anticipate a potential reversal in the price of the asset and adjust their trading strategies accordingly.