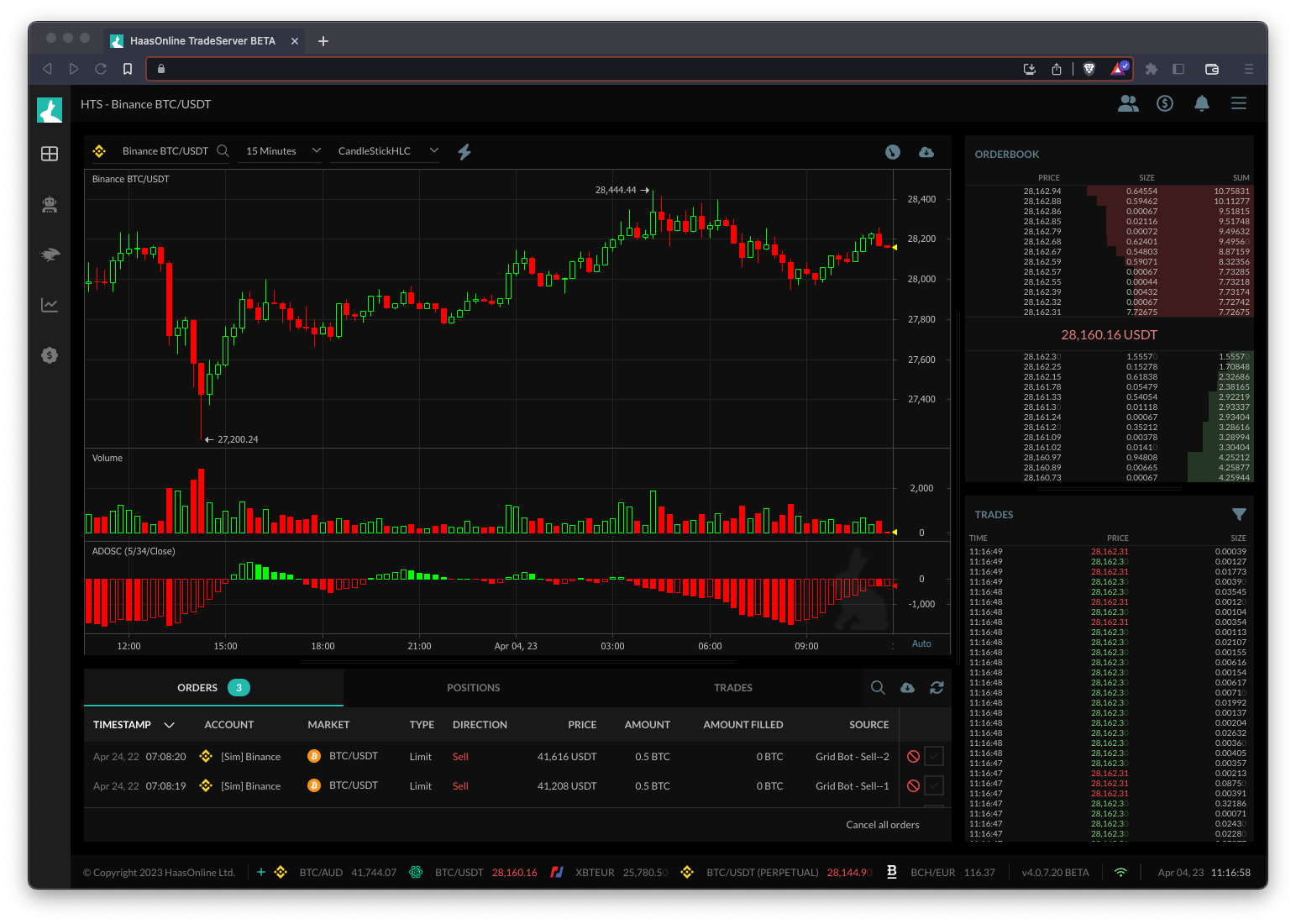

Accumulation/Distribution Oscillator (ADOSC)

The Accumulation/Distribution Oscillator (ADO) is a technical indicator that measures the momentum of the Accumulation/Distribution Line (ADL). The ADL is a volume-based indicator that uses price and volumeVolume refers to the total amount of a cryptocurrency that has been traded within a specific time period, usually 24 hours. It is a key... More to assess buying and selling pressure. The ADO is derived by taking the difference between a fast and slow moving average of the ADL.

The ADO is used to identify trend reversals and divergence between price and volume. When the ADO crosses above the zero line, it is considered a buy signal, and when it crosses below the zero line, it is considered a sell signal. Divergence between the ADO and price can indicate an upcoming trend reversal.

Trading bots like HaasOnline can use the ADO as a signal for buying or selling assets. The ADO can be added as a technical indicator to a trading bot’s strategy, and the bot can be configured to make trades based on the ADO’s signals. The bot can be set to buy when the ADO crosses above the zero line and sell when it crosses below the zero line.