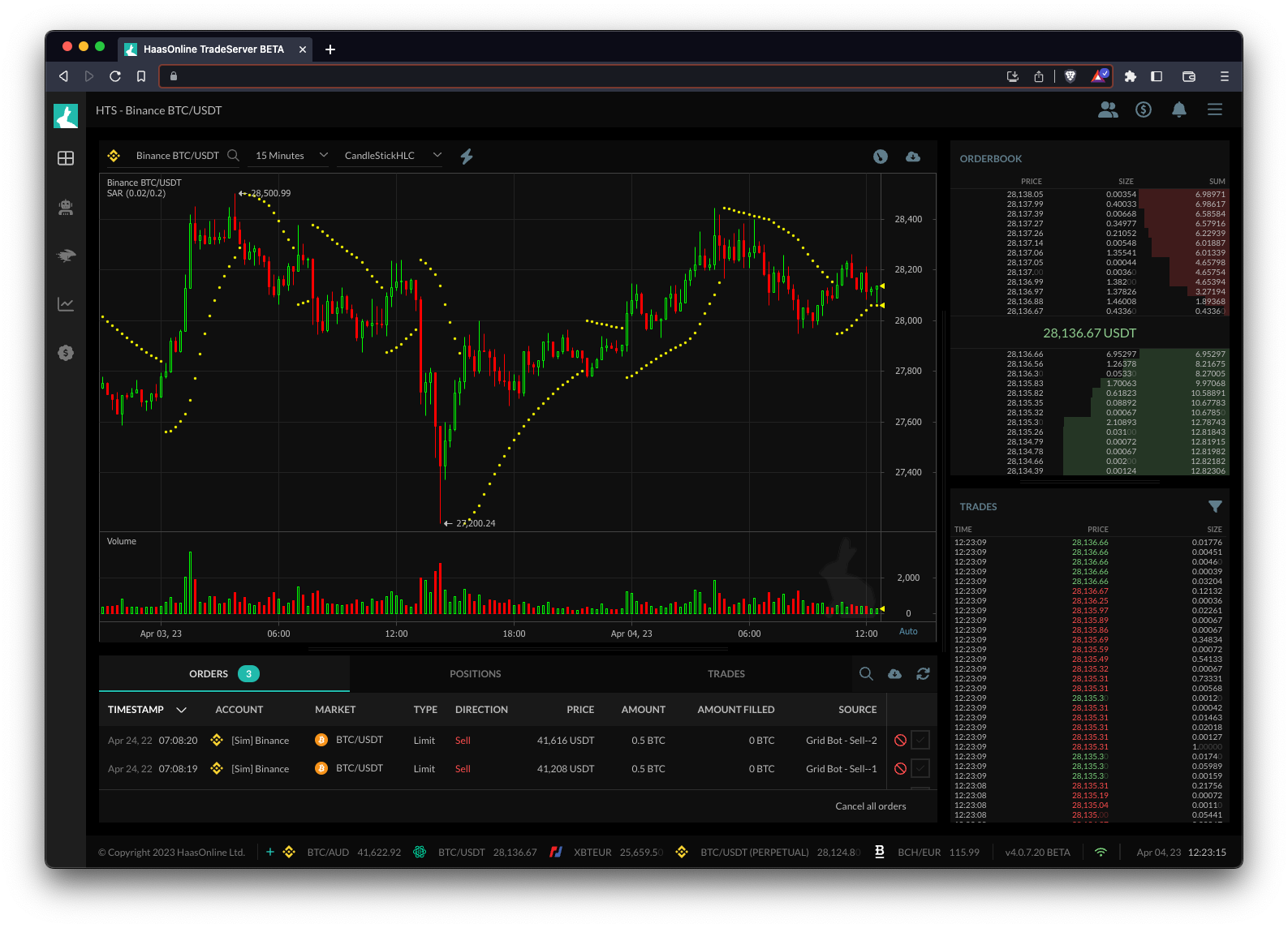

Parabolic SAR (PSAR)

The Parabolic SAR (Stop and Reverse) is a technical indicator that uses trailing stop and reverse points to identify potential reversals in price direction. It is primarily used to determine the direction of an asset’s trend and generate buy or sell signals.

When the Parabolic SAR is below the price, it is considered a bullish signal, indicating that the trend is moving upward. When the Parabolic SAR is above the price, it is considered a bearish signal, indicating that the trend is moving downward.

Trading bots like HaasOnline can be programmed to use the Parabolic SAR as part of their trading strategy. For example, a bot can be programmed to buy an asset when the Parabolic SAR switches from being above the price to being below the price, indicating a potential reversal in trend. Similarly, the bot can be programmed to sell an asset when the Parabolic SAR switches from being below the price to being above the price, indicating a potential downward trend.