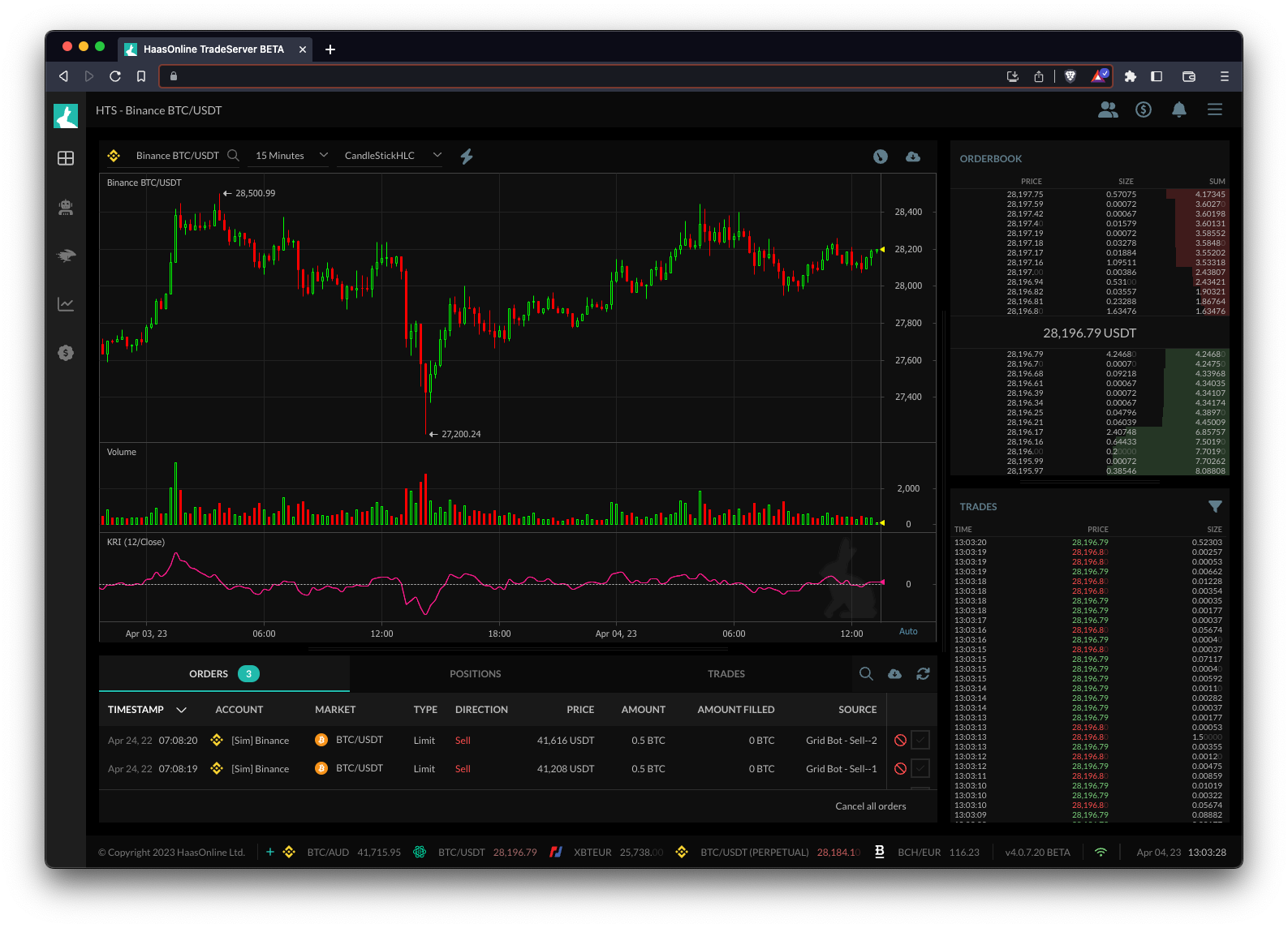

Kairi Relative Index

The Kairi Relative IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... is a technical indicator used in trading to identify the long-term trend of a financial asset. It is calculated by comparing the current price of an asset to its simple moving average over a certain period of time.

Specifically, the Kairi Relative Index is calculated as follows:

- Determine the simple moving average of the asset’s price over a specified number of periods (e.g., 20, 50, or 100).

- Divide the current price of the asset by its simple moving average.

- Multiply the result by 100 to get the Kairi Relative Index.

The resulting Kairi Relative Index value indicates whether the asset is currently overbought or oversold relative to its long-term trend. If the Kairi Relative Index is above 100, it suggests that the asset is overbought and may be due for a price correction. Conversely, if the Kairi Relative Index is below 100, it suggests that the asset is oversold and may be due for a price rebound.

In trading bots like HaasOnline, the Kairi Relative Index can be used as a signal for executing trades. For example, a trading bot may be programmed to buy an asset when the Kairi Relative Index falls below a certain threshold (indicating that the asset is oversold) and to sell when the Kairi Relative Index rises above another threshold (indicating that the asset is overbought).