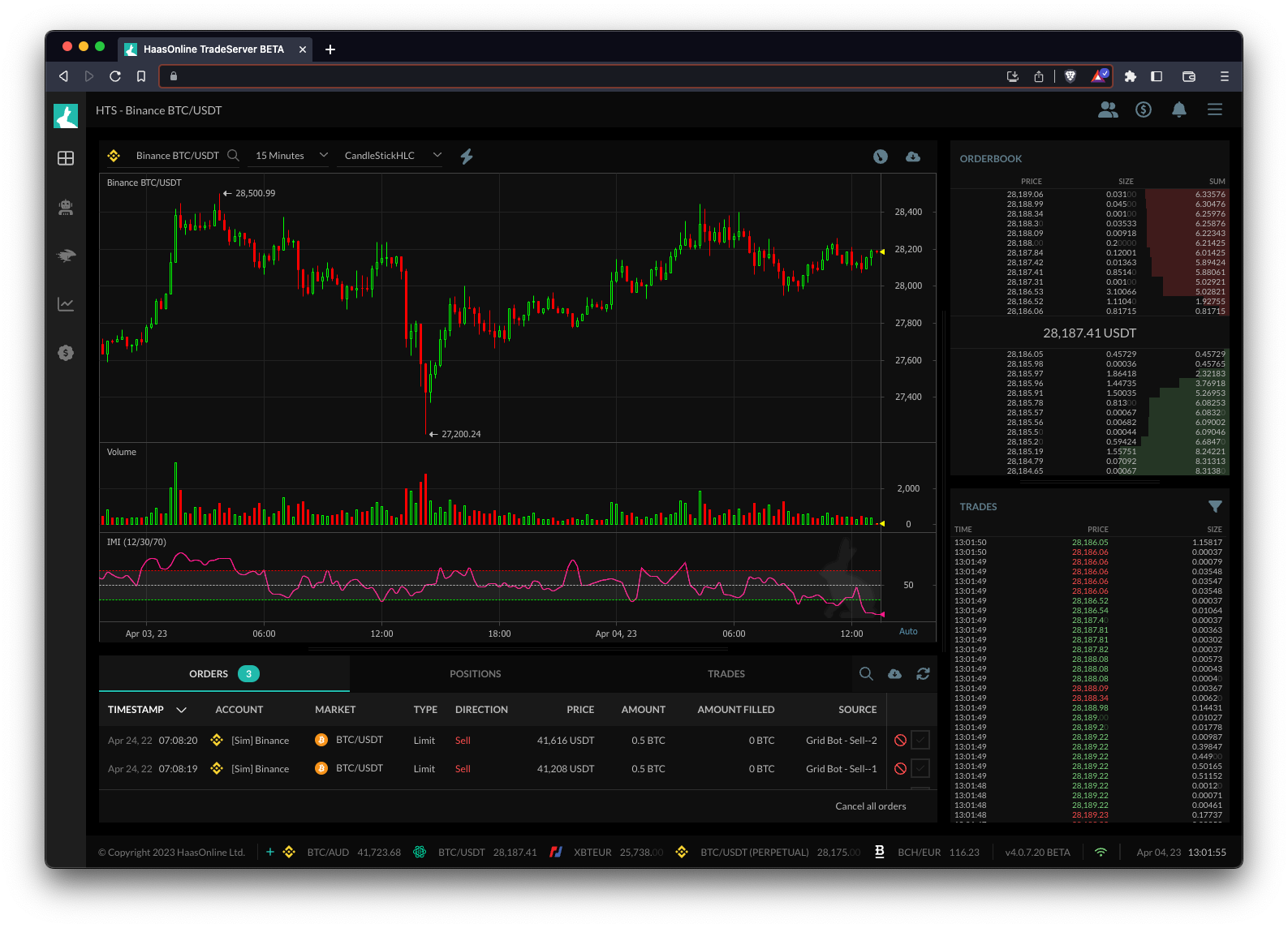

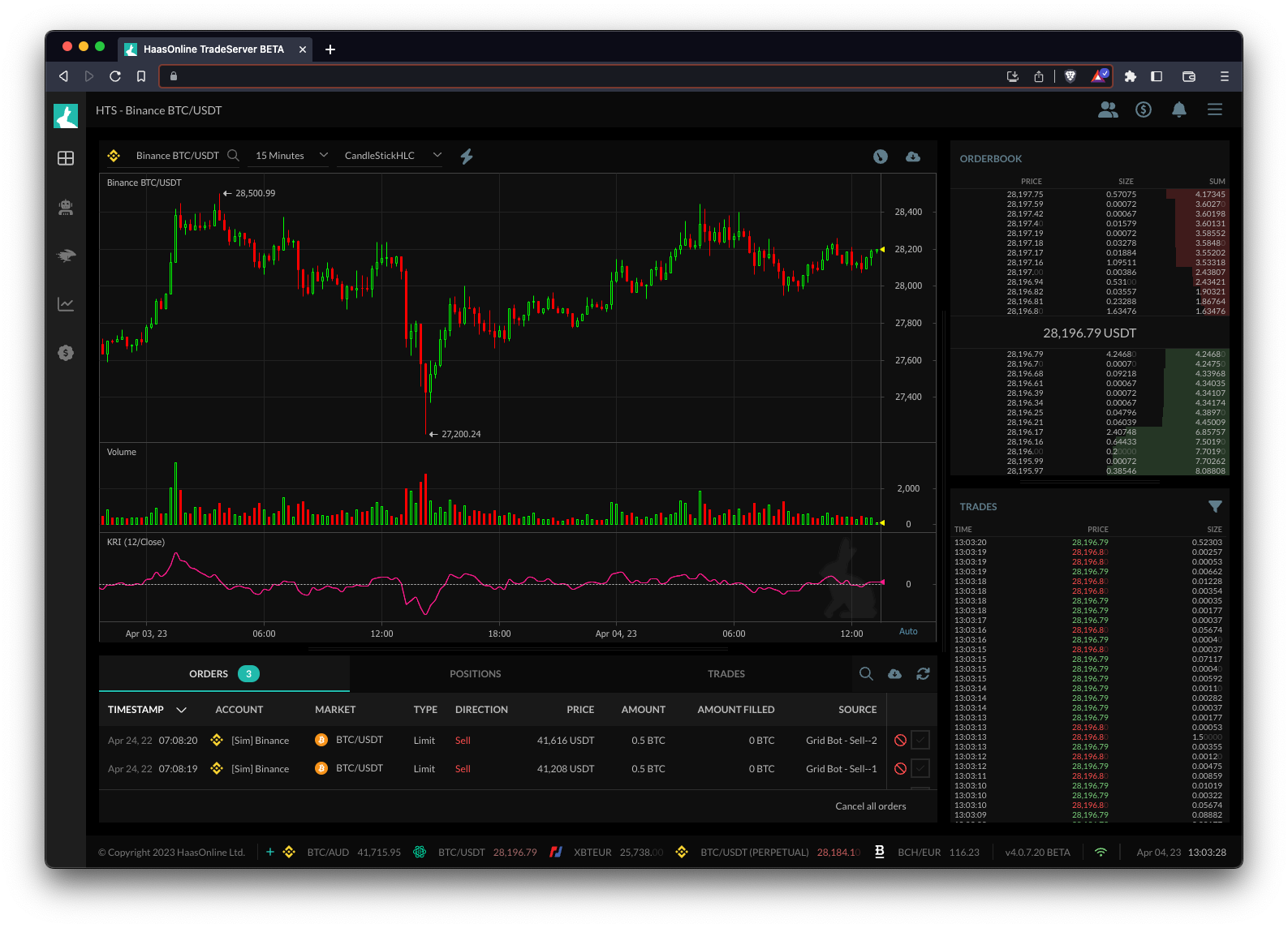

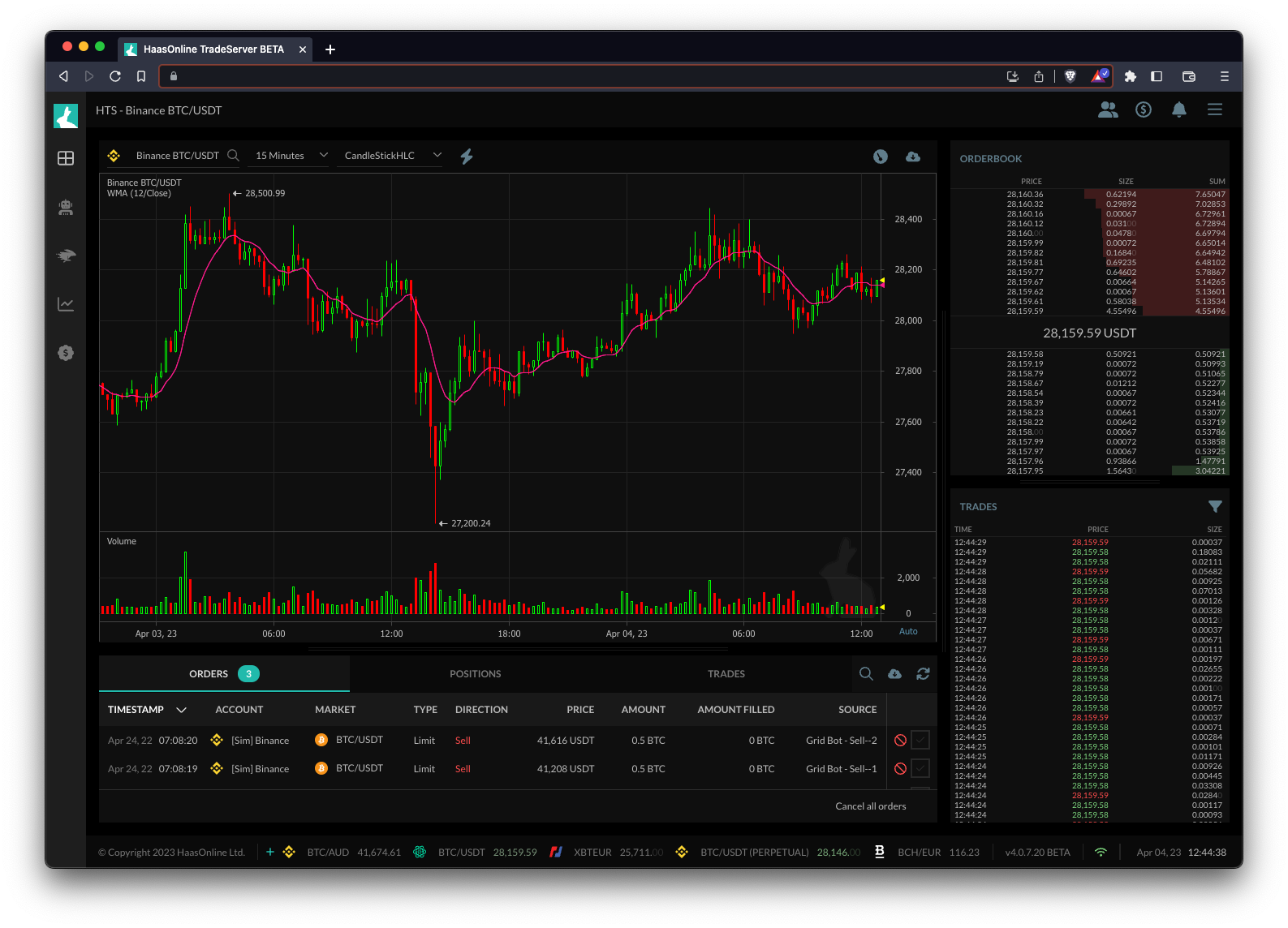

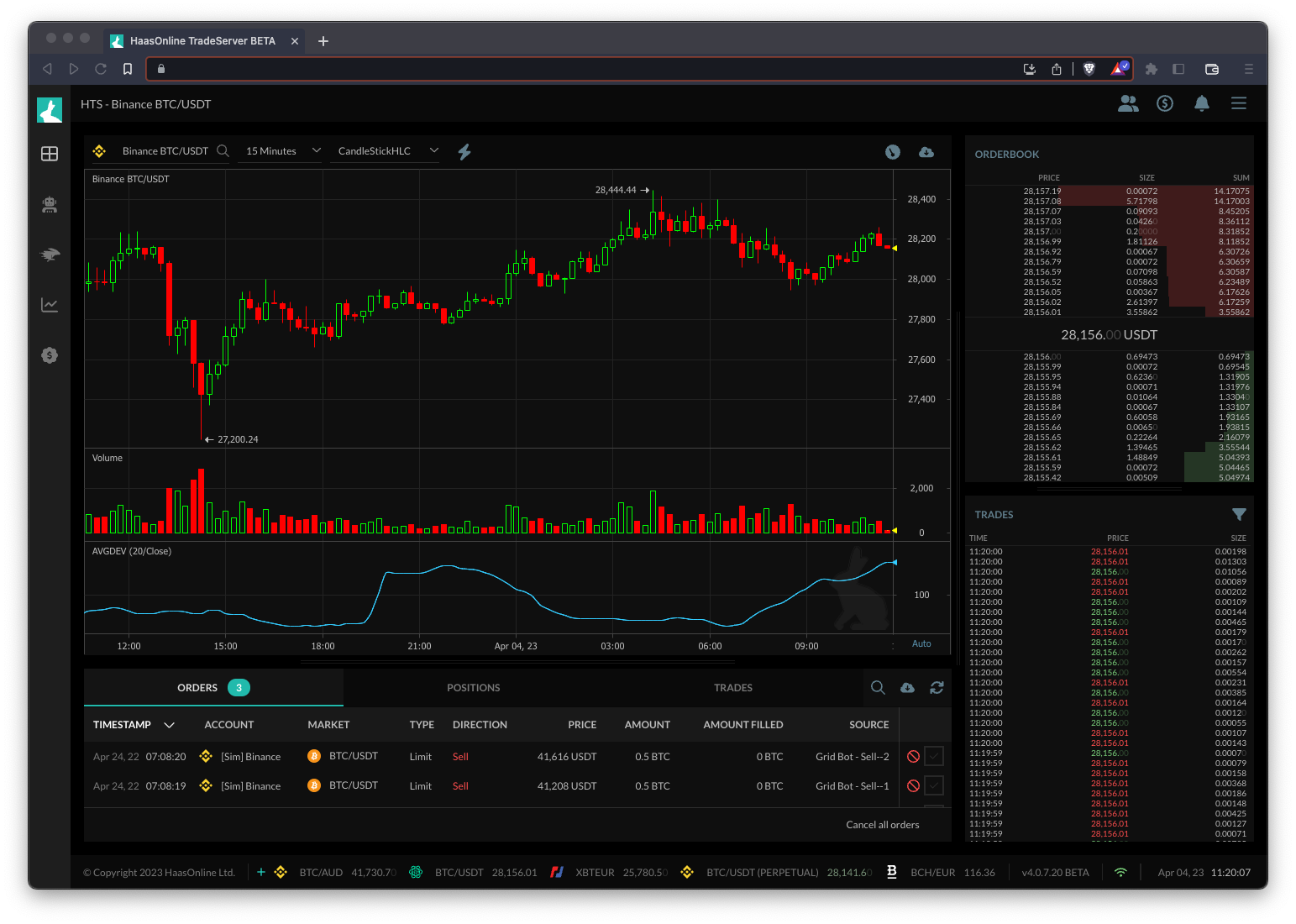

Intraday Momentum Index

The Intraday Momentum IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (IMI) is a technical indicator used to measure the momentum of an asset’s price actionAs a trader, price action refers to the movement of the price of a cryptocurrency over time. It's the study of how the price changes... More on an intraday basis. The IMI is similar to the Relative Strength Index (RSI) in that it uses the ratio of positive price changes to negative price changes to determine overbought and oversold conditions. However, the IMI is specifically designed to analyze intraday price action, making it useful for short-term traders.

In HaasOnline trading bots, the IMI can be used as a signal for buying or selling an asset. Traders can set up their bots to generate buy signals when the IMI is oversold and sell signals when the IMI is overbought. The IMI can also be used in conjunction with other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and... More to confirm trading signals and improve overall trading performance.