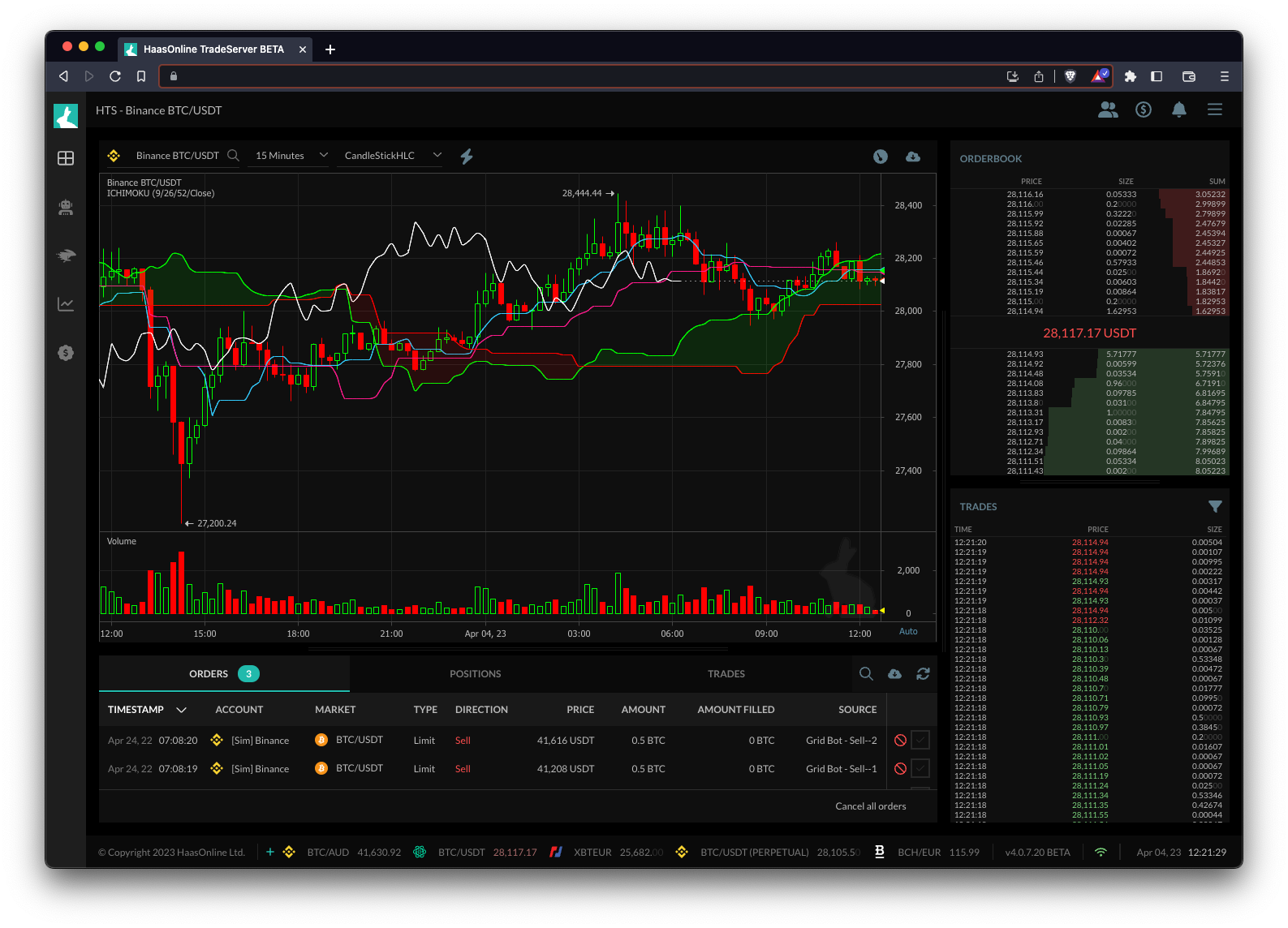

Ichimoku Clouds

The Ichimoku Clouds technical indicator, also known as Ichimoku Kinko Hyo, is a popular indicator in technical analysis that helps traders identify trends, momentum, and supportIn technical analysis, a support line is a price level at which demand for an asset is thought to be strong enough to prevent the.../resistance levels. It consists of five lines that form a cloud-like structure, including the Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span).

Traders use the Ichimoku Clouds to identify potential buy and sell signals. For example, when the price is above the cloud, it is considered a bullish signal, while a price below the cloud is considered bearish. Traders also look for crossovers between the Tenkan-sen and Kijun-sen lines, as well as the Senkou Span A and B lines, as potential signals for trend changes.

Trading bots like HaasOnline can use the Ichimoku Clouds technical indicator to automate trades based on predefined strategies. For example, a bot can be programmed to enter a long position when the price crosses above the cloud and the Tenkan-sen crosses above the Kijun-sen. Conversely, it can enter a short position when the price crosses below the cloud and the Tenkan-sen crosses below the Kijun-sen. By using the Ichimoku Clouds in combination with other indicators, traders can develop sophisticated trading strategies to take advantage of market movements.