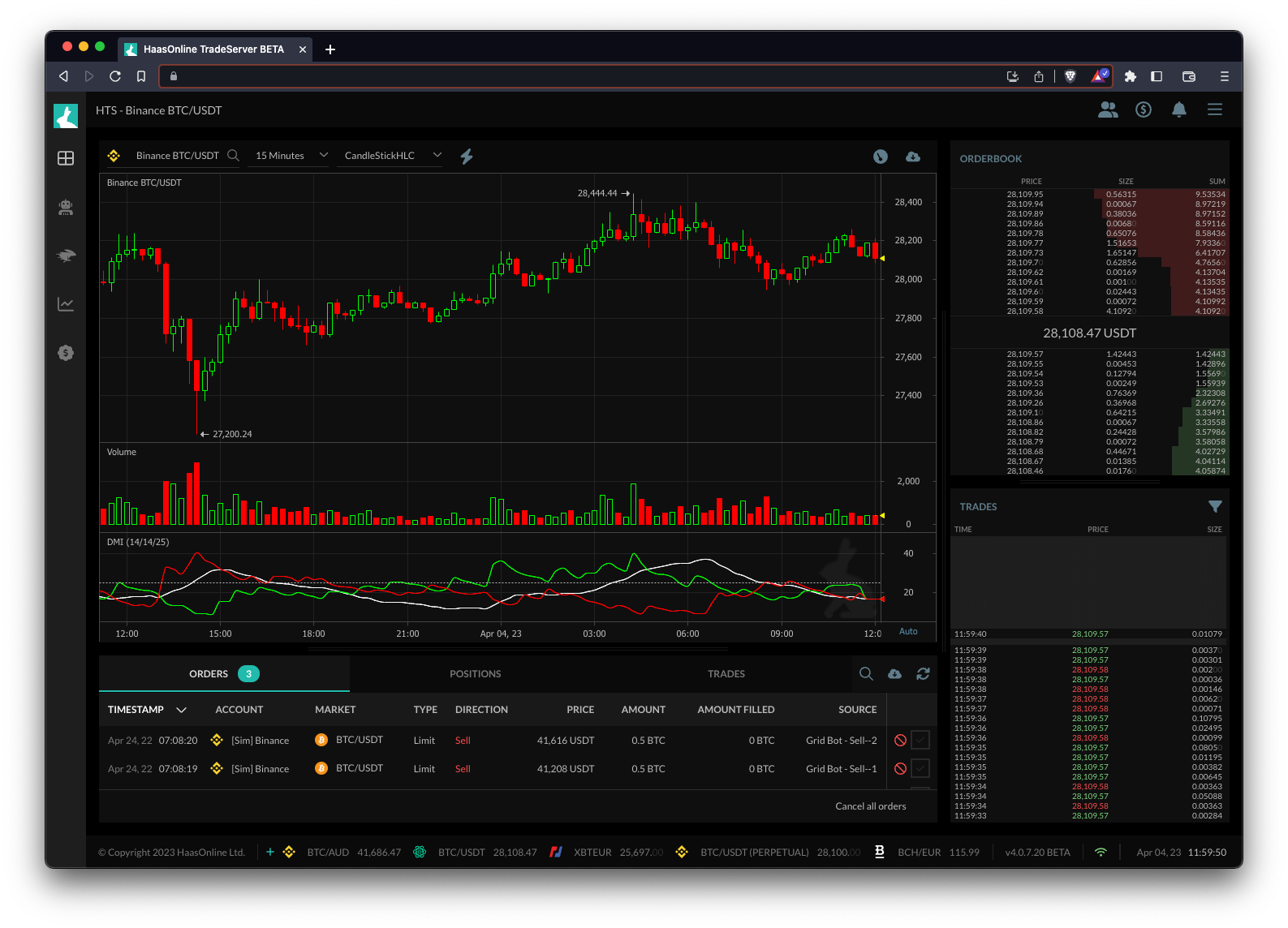

Directional Movement Index

The Directional Movement IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (DMI) is a technical indicator that measures the strength and direction of a trend. It is composed of two lines: the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI).

The +DI measures the strength of upward movement in the price, while the -DI measures the strength of downward movement. When the +DI is above the -DI, it indicates a bullish trend, and when the -DI is above the +DI, it indicates a bearish trend.

In addition to the +DI and -DI lines, the DMI also includes a third line called the Average Directional Index (ADX), which indicates the strength of the trend, regardless of its direction.

Trading bots like HaasOnline can use the DMI indicator to automate trading strategies based on trend direction and strength. For example, a bot could be programmed to enter a long position when the +DI crosses above the -DI, indicating a bullish trend, and exit the position when the -DI crosses above the +DI, indicating a bearish trend. The bot could also use the ADX line to filter out trades during periods of low trend strength.