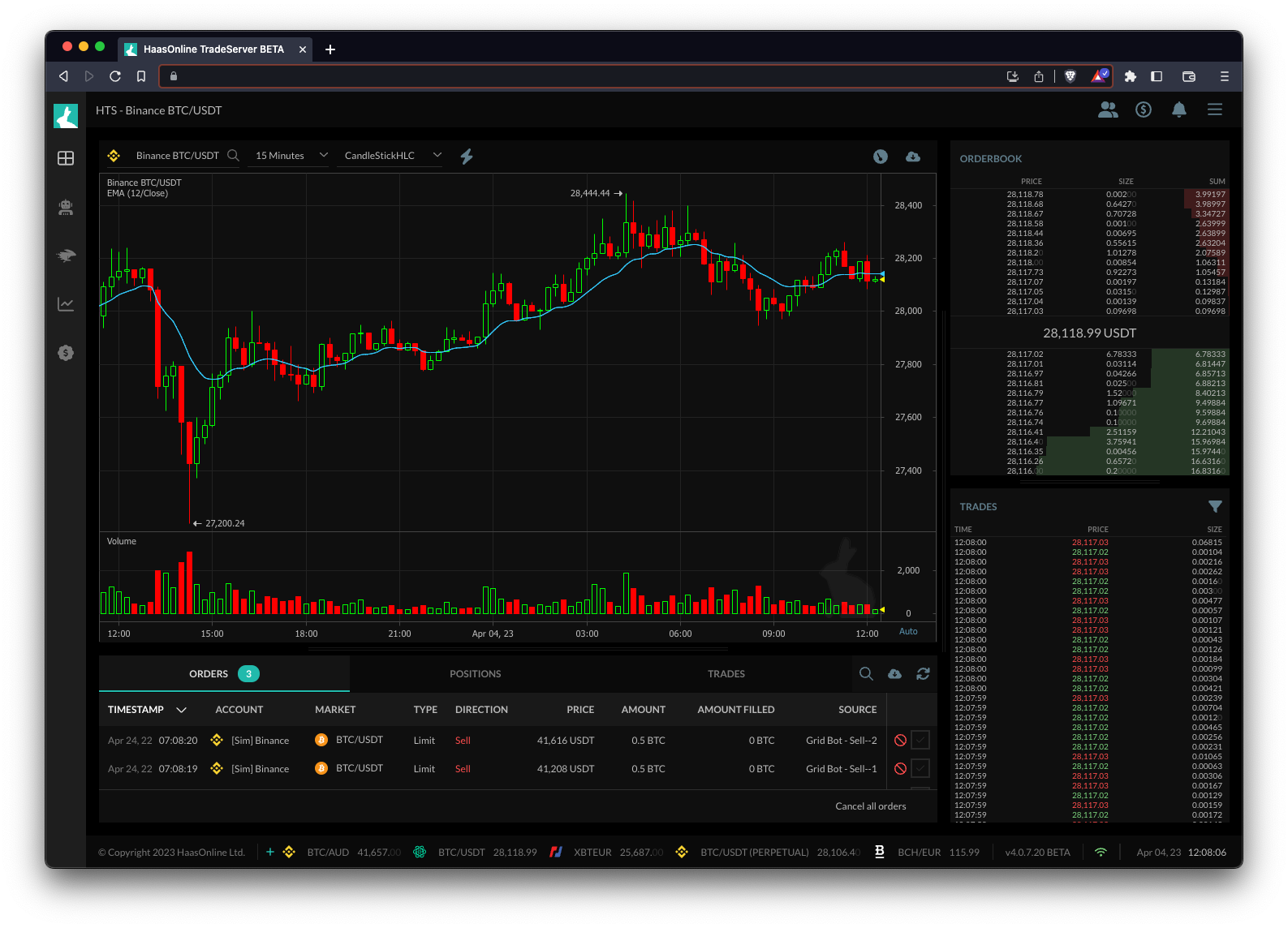

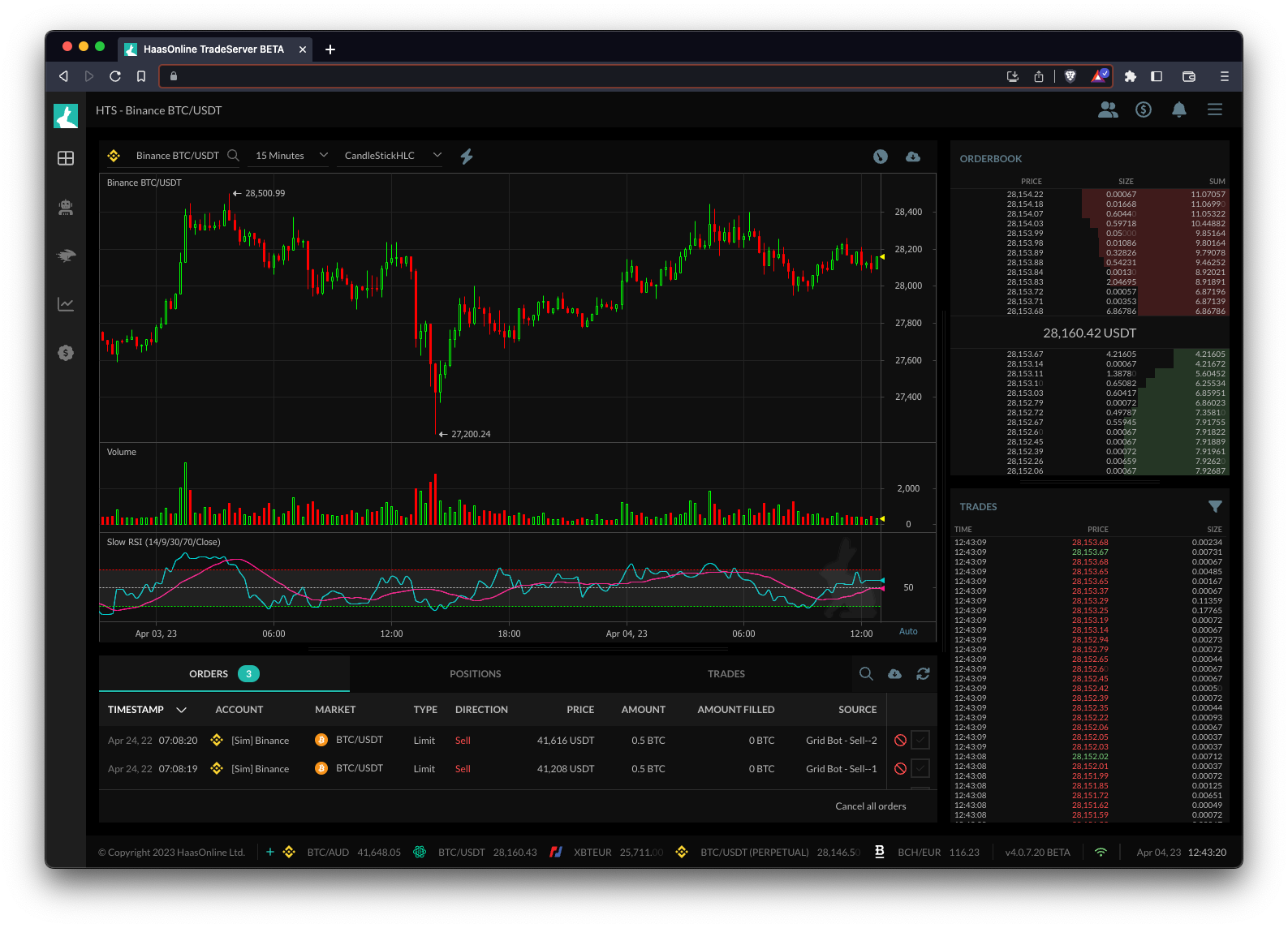

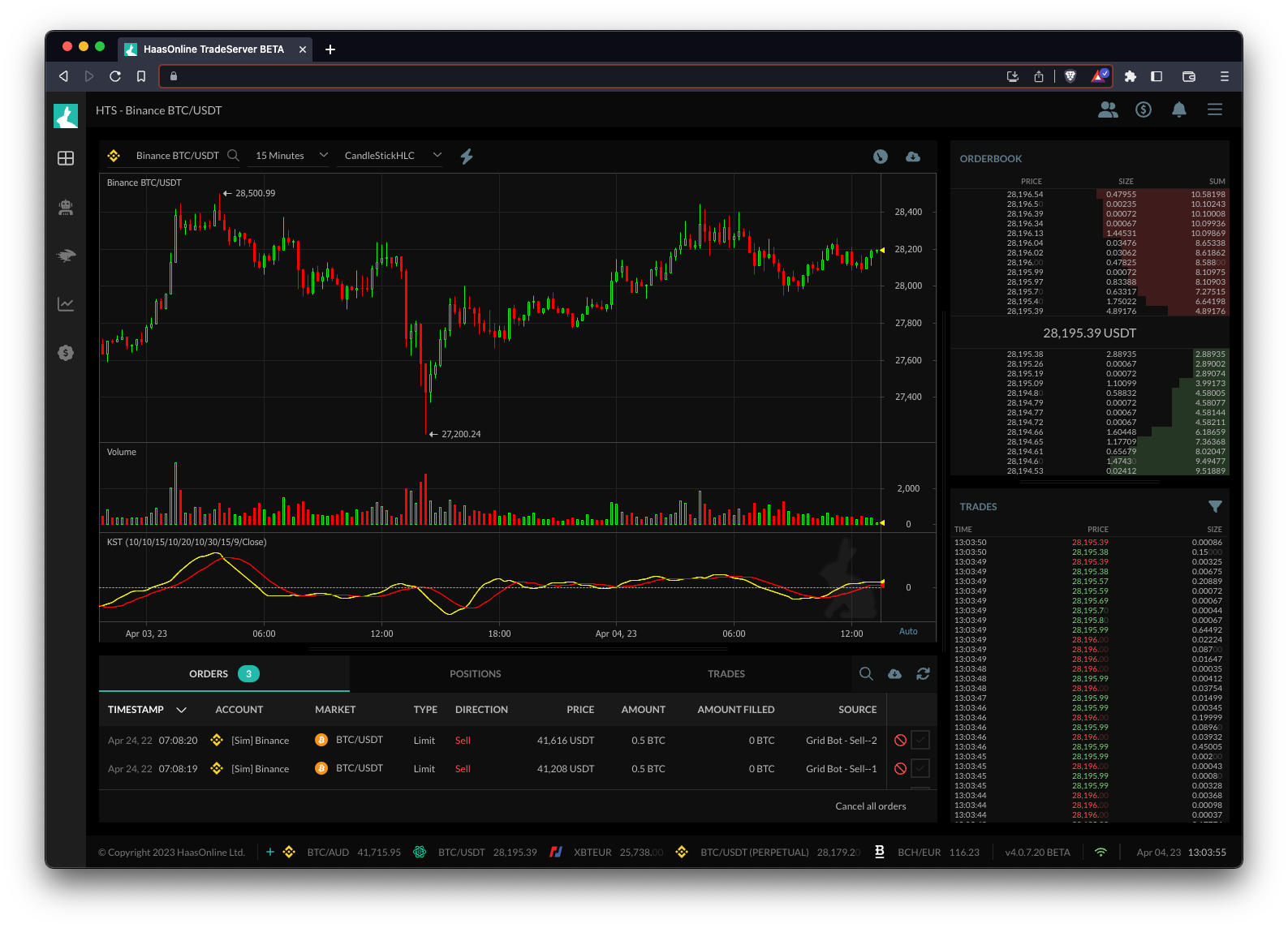

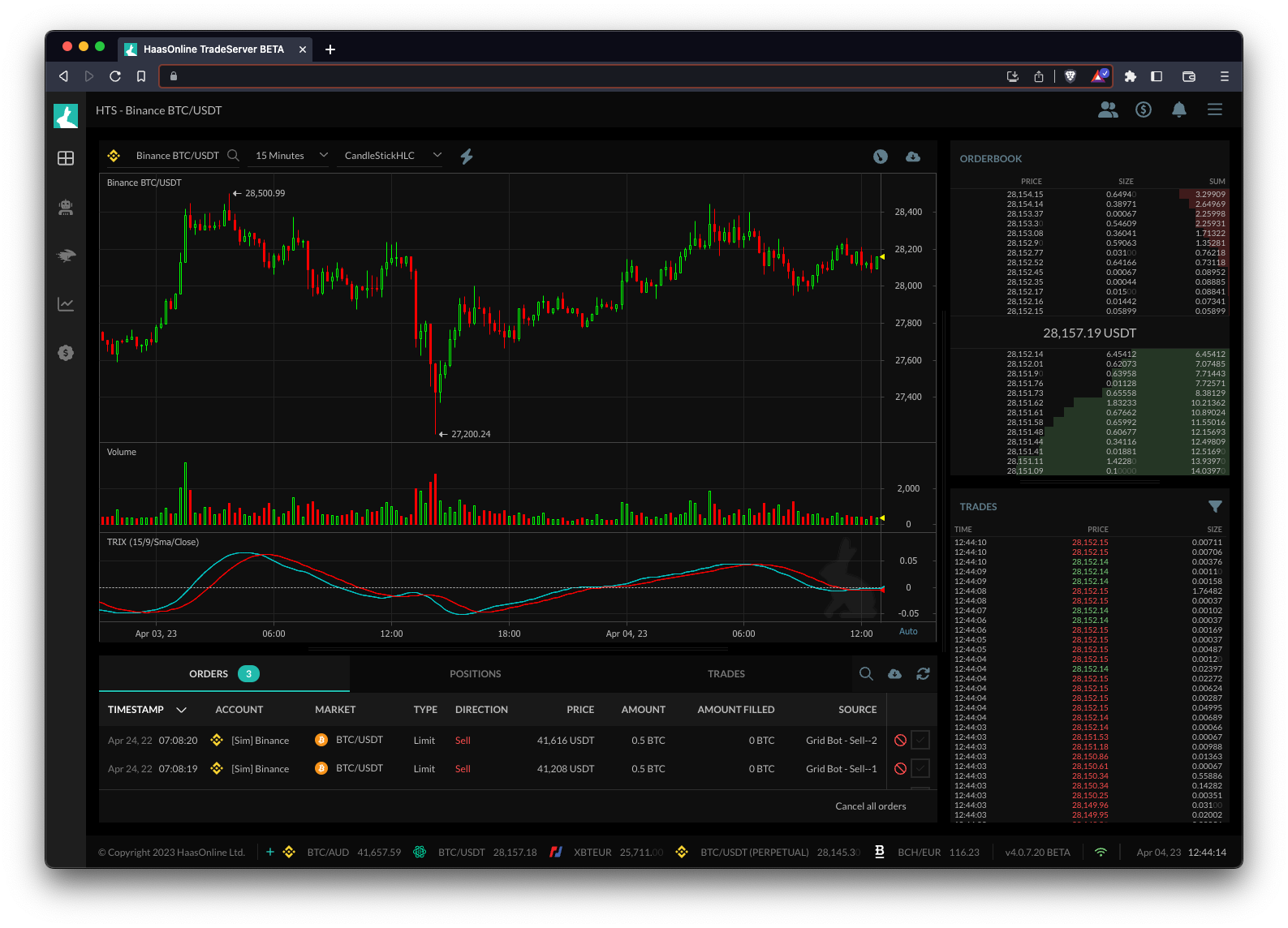

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a technical indicator that calculates the average price of an asset over a specified period, with greater weight given to more recent data. In simple terms, it is a moving average that places more emphasis on recent price actionAs a trader, price action refers to the movement of the price of a cryptocurrency over time. It's the study of how the price changes....

EMA can be used by trading bots to identify the overall trend of an asset and generate buy or sell signals based on crossovers of different EMAs, such as the 9-day EMA and the 21-day EMA. When the 9-day EMA crosses above the 21-day EMA, it can indicate a bullish signal, while a crossover in the opposite direction may signal a bearish signal.

In HaasOnline’s trading bot software, traders can use the EMA as a part of their overall strategy to make buy or sell decisions, as well as use it as a condition for automated trades. By setting up an EMA-based strategy, traders can benefit from the signal generation and automation capabilities of the software, and potentially increase their profits.