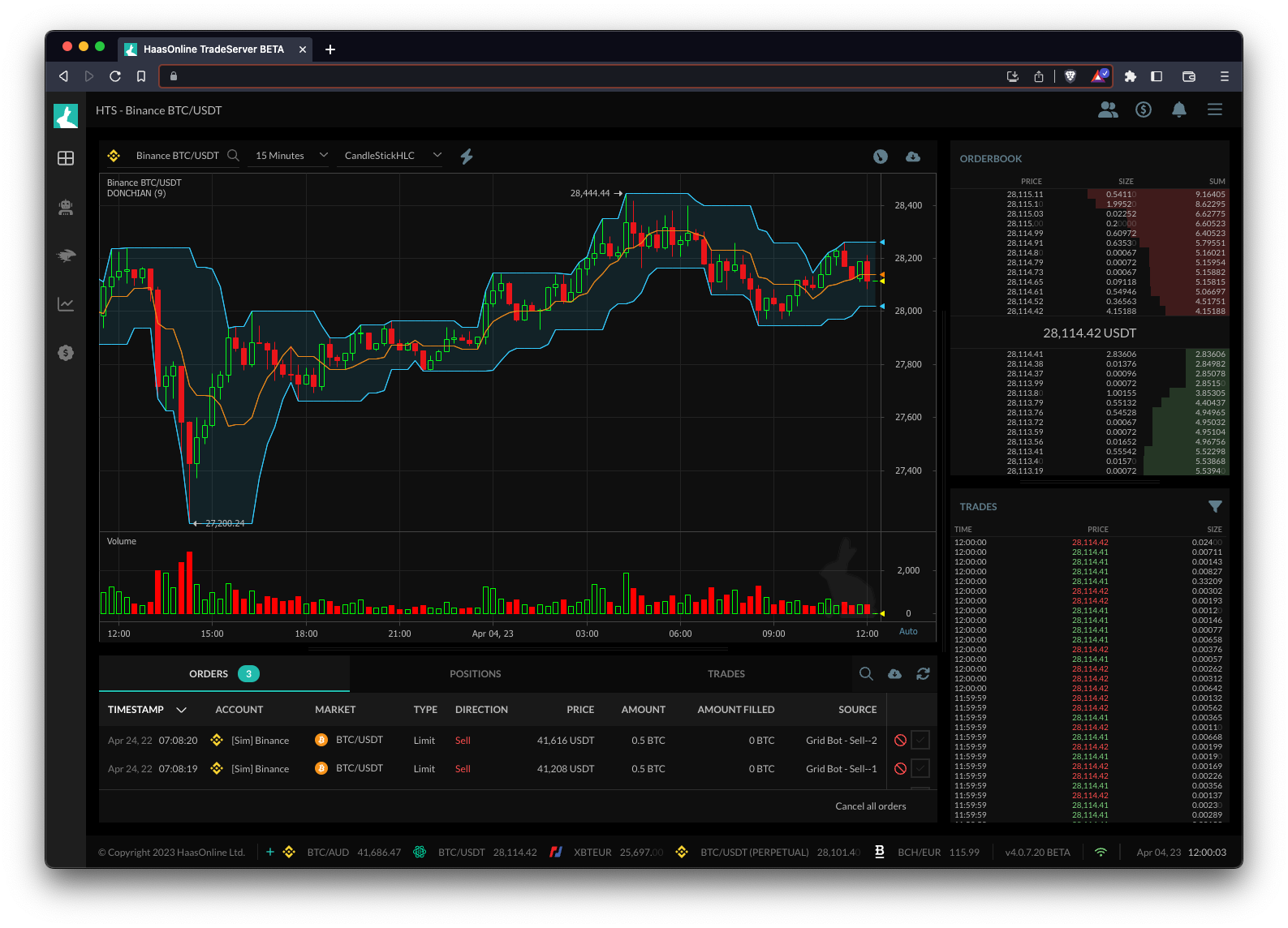

Donchian Channels

The Donchian Channels technical indicator is a popular trend-following indicator used in trading to identify the current trend and potential entry and exit points. The Donchian Channels consist of three lines: an upper line, a lower line, and a middle line. The upper and lower lines are plotted based on the highest and lowest prices over a specified period, while the middle line is the average of the two.

In a bullish trend, the price tends to stay above the middle line and sometimes touches the upper line. In a bearish trend, the price tends to stay below the middle line and sometimes touches the lower line. When the price breaks through the upper or lower line, it may signal a trend reversal or a breakoutA breakout is a technical analysis term used in cryptocurrency trading that refers to a price movement that breaks through an established resistance level or....

Trading bots like HaasOnline can use the Donchian Channels indicator to develop automated trading strategies based on trend following and breakouts. For example, a bot could be programmed to buy when the price breaks above the upper line and sell when it breaks below the lower line. The length of the period used to calculate the Donchian Channels can also be adjusted to match the specific trading style and time frame.