Directional Index

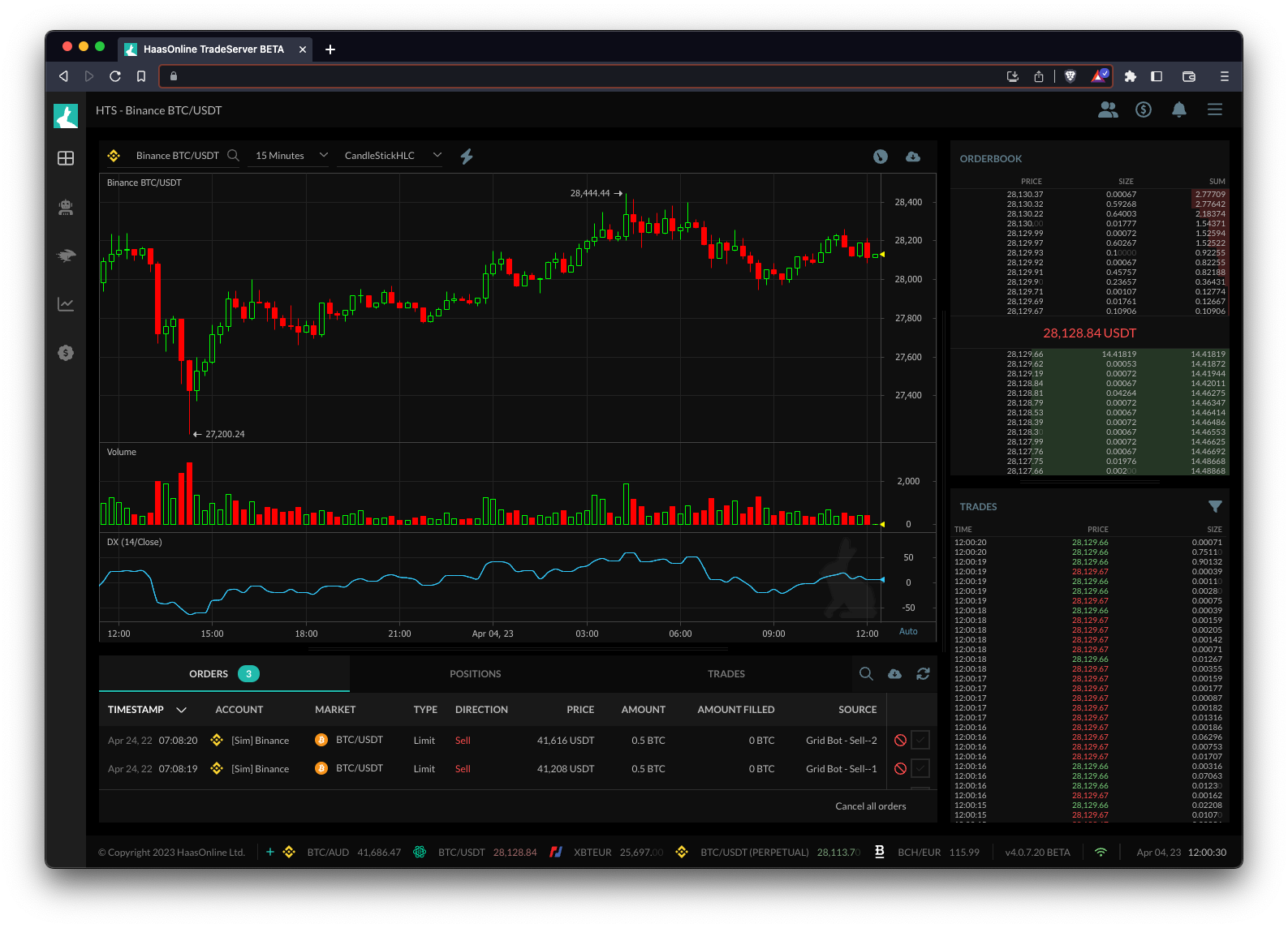

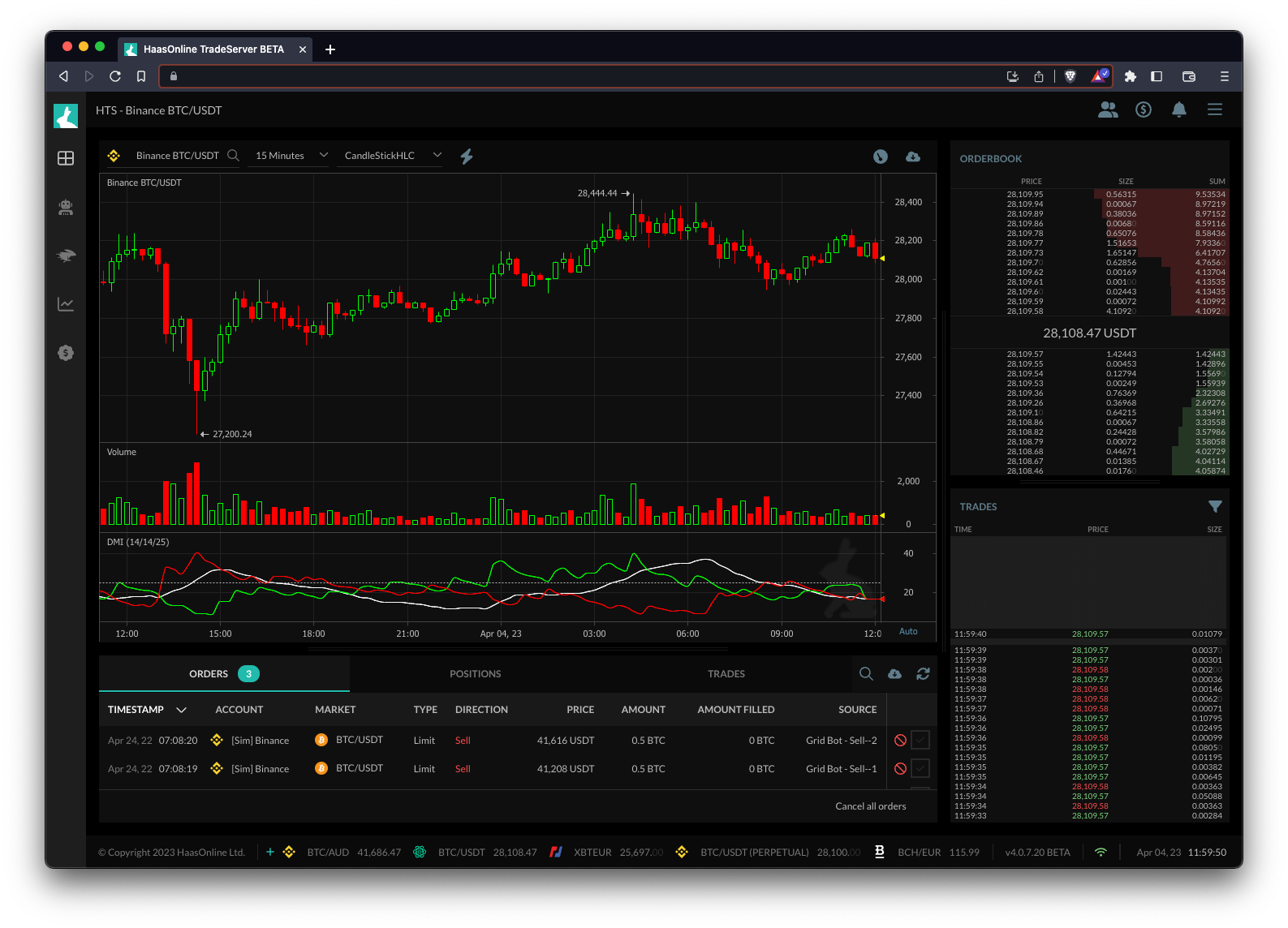

The Directional IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (DI) is a technical indicator that helps traders identify trends and determine the strength of a trend. It consists of two lines, the positive Directional Indicator (+DI) and the negative Directional Indicator (-DI), which are used to calculate the ADX (Average Directional Index) line.

The +DI line measures the strength of buying pressure, while the -DI line measures the strength of selling pressure. The ADX line is used to indicate the strength of the trend, with values above 25 indicating a strong trend.

Traders can use the DI and ADX lines to identify potential trend reversals and adjust their trading strategies accordingly. For example, if the +DI line crosses above the -DI line, it may indicate a bullish trend, while a cross below may indicate a bearish trend.

Trading bots like HaasOnline can use the DI and ADX lines to automate trades based on trend strength and potential trend reversals. For example, a bot could be programmed to enter a long position if the +DI line crosses above the -DI line and the ADX line is above 25, indicating a strong bullish trend.