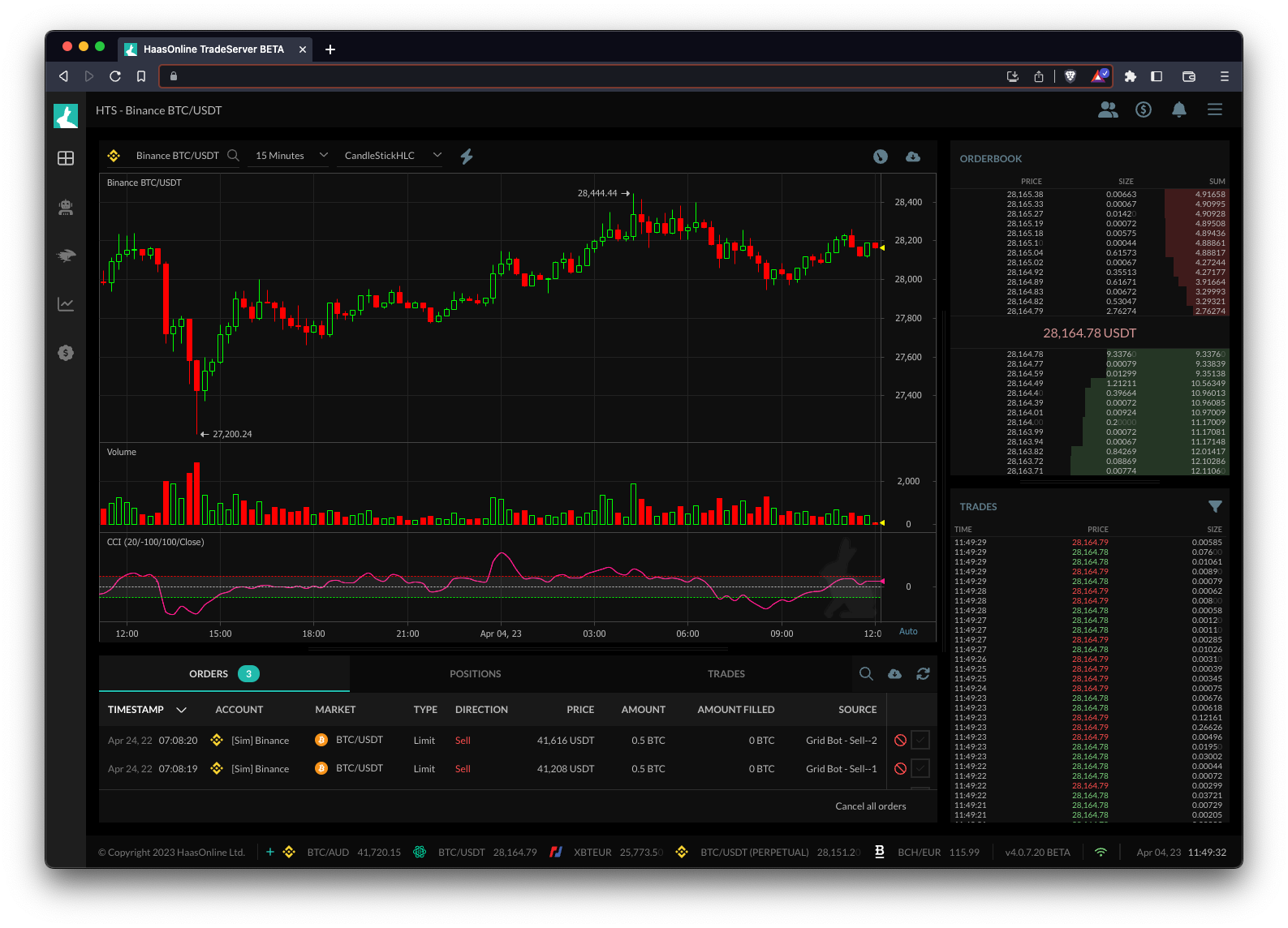

Commodity Channel Index (CCI)

The Commodity Channel IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... (CCI) is a technical analysis indicator that measures the current price level relative to an average price level over a given period of time. The CCI is used to identify overbought and oversold levels and to assess price trend direction and strength.

In HaasOnline trading bot software, the CCI indicator can be used in a variety of ways, including:

- Trading signals: The CCI can be used to generate buy and sell signals based on overbought and oversold conditions.

- Trend identification: The CCI can be used to identify the direction and strength of a price trend. Traders can use this information to make informed trading decisions.

- Divergence: The CCI can be used to identify divergence between the price of an asset and the CCI indicator. Divergence can be a signal of a potential trend reversal.

- SupportIn technical analysis, a support line is a price level at which demand for an asset is thought to be strong enough to prevent the... and resistanceIn technical analysis, resistance refers to a level on a chart where there is significant selling pressure and the price of an asset struggles to...: The CCI can be used to identify key support and resistance levels based on overbought and oversold conditions.

Overall, the CCI indicator can be a useful tool for traders looking to make informed trading decisions based on technical analysis. However, as with any trading indicator, it should be used in conjunction with other analysis techniques and risk management strategies to minimize potential losses.