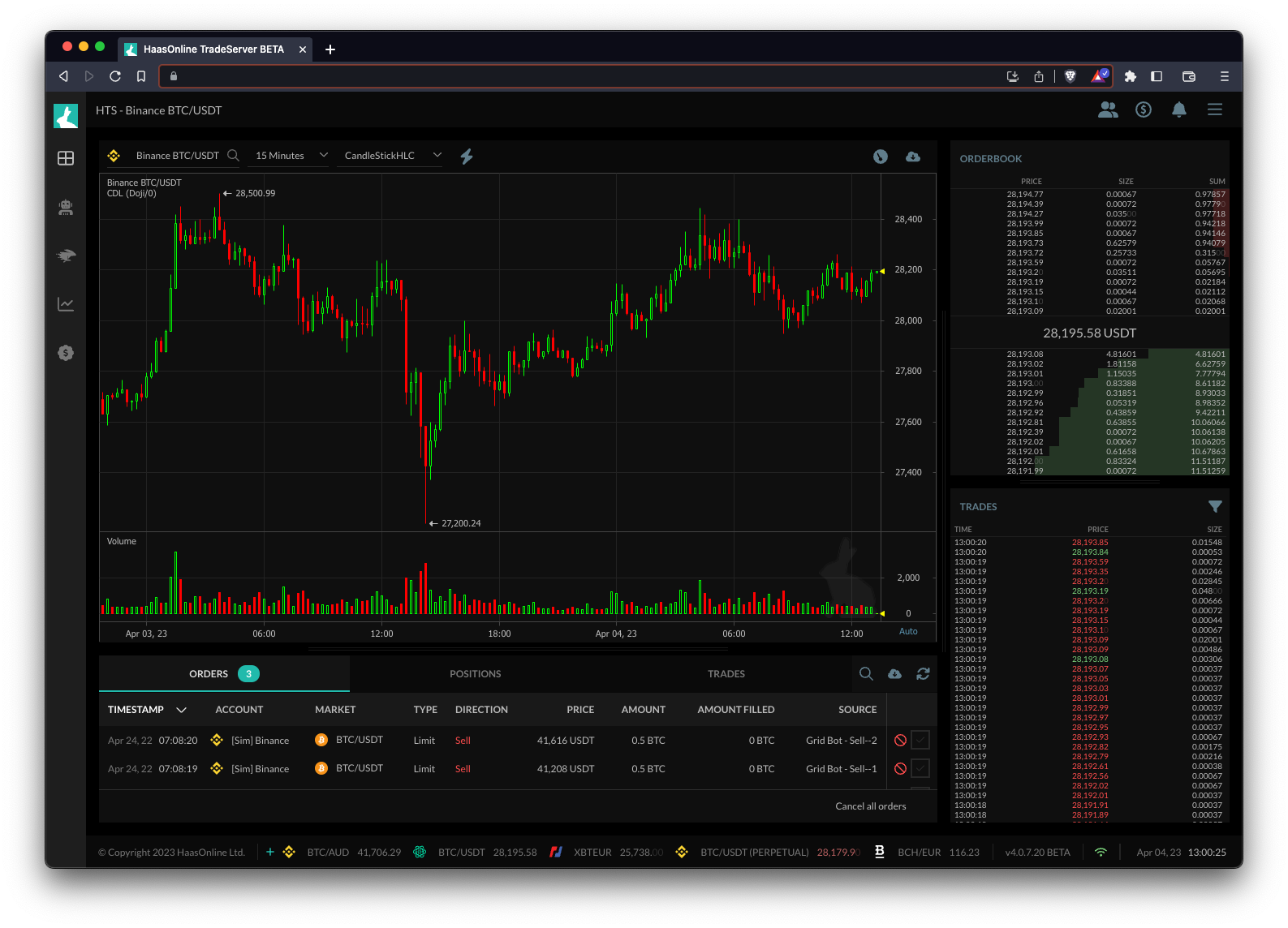

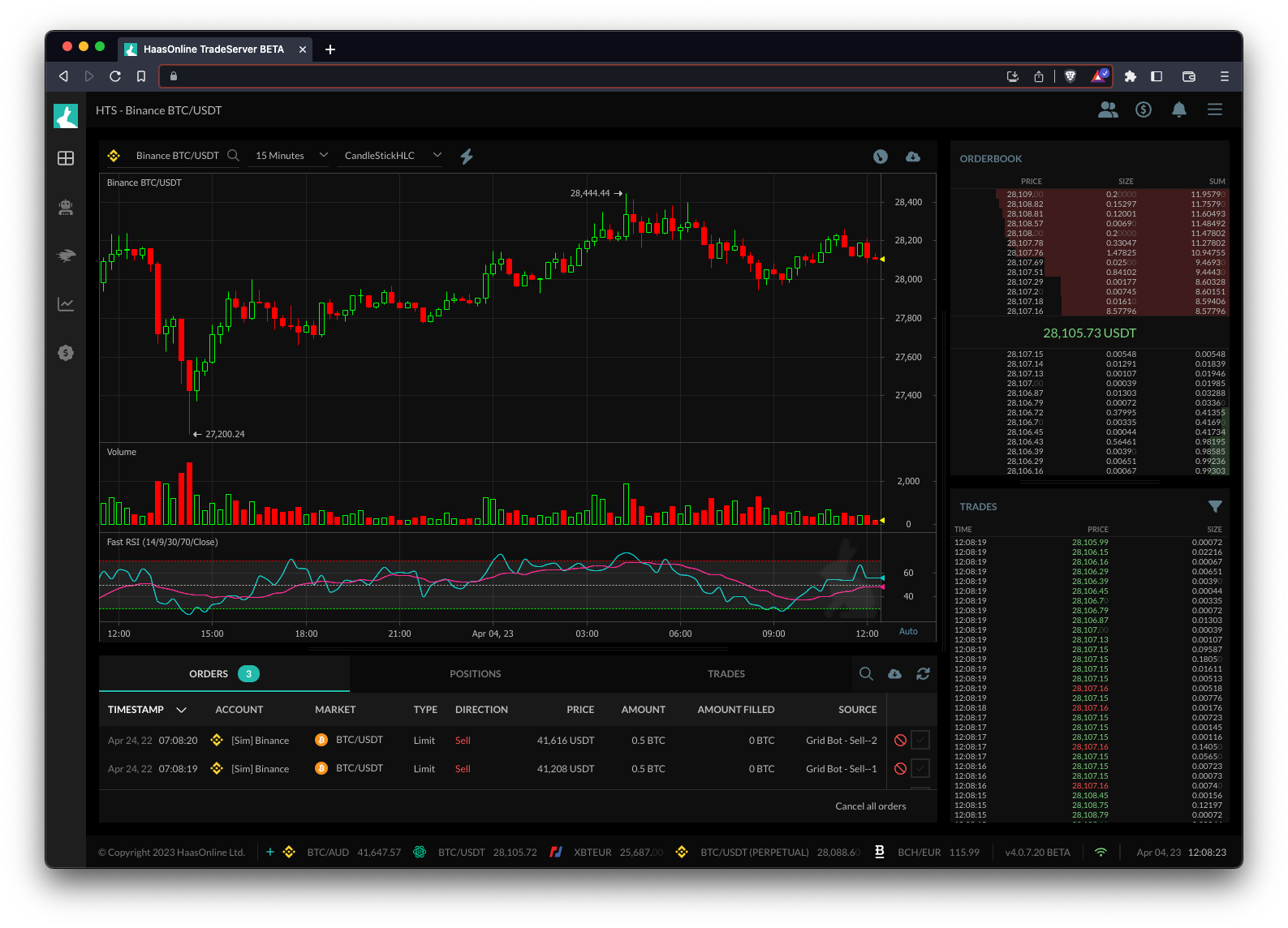

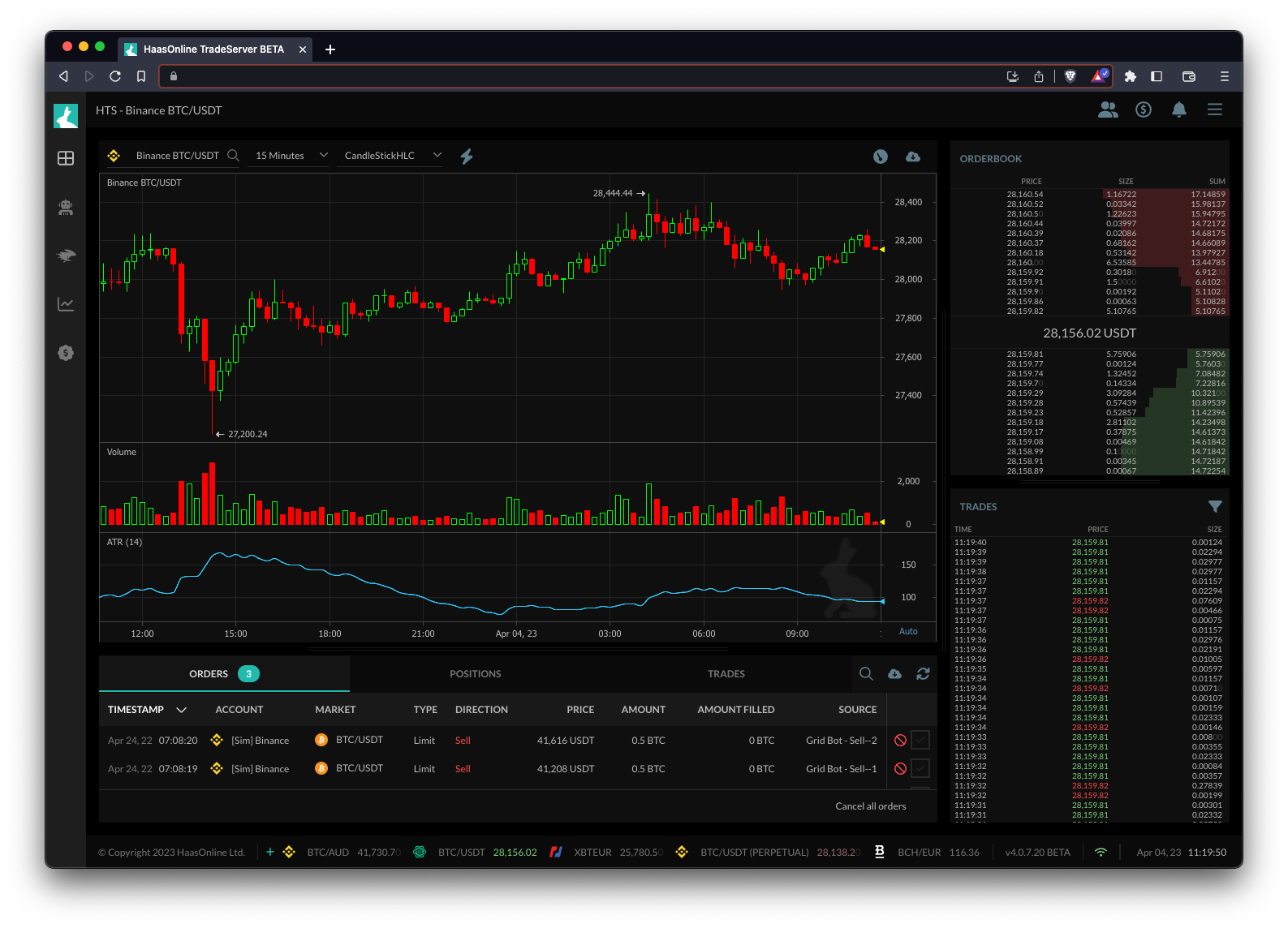

Candle Pattern

Candlestick patterns are a form of technical analysis used in trading to identify potential reversal or continuation patterns in the market. They are based on the interpretation of price actionAs a trader, price action refers to the movement of the price of a cryptocurrency over time. It's the study of how the price changes... More, represented by the open, high, low, and close of a given period (usually a day). The patterns are formed by the combination of these four price points, and they can signal potential shifts in market sentimentIn the context of trading, sentiment refers to the overall attitude or feeling of investors or traders towards a particular asset or market. It can... More.

Trading bots like HaasOnline can use candlestick patternsCandlestick patterns are a common tool used in technical analysis to predict future price movements in financial markets. The patterns are formed by a series... More as part of their trading strategies. They can be programmed to recognize specific patterns, such as dojis, hammers, or engulfing patterns, and use them as signals to enter or exit trades. The effectiveness of candlestick patterns as a trading tool depends on the trader’s skill in correctly identifying and interpreting them. However, when used in combination with other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and... More, candlestick patterns can provide valuable insights into the market and help traders make informed trading decisions.