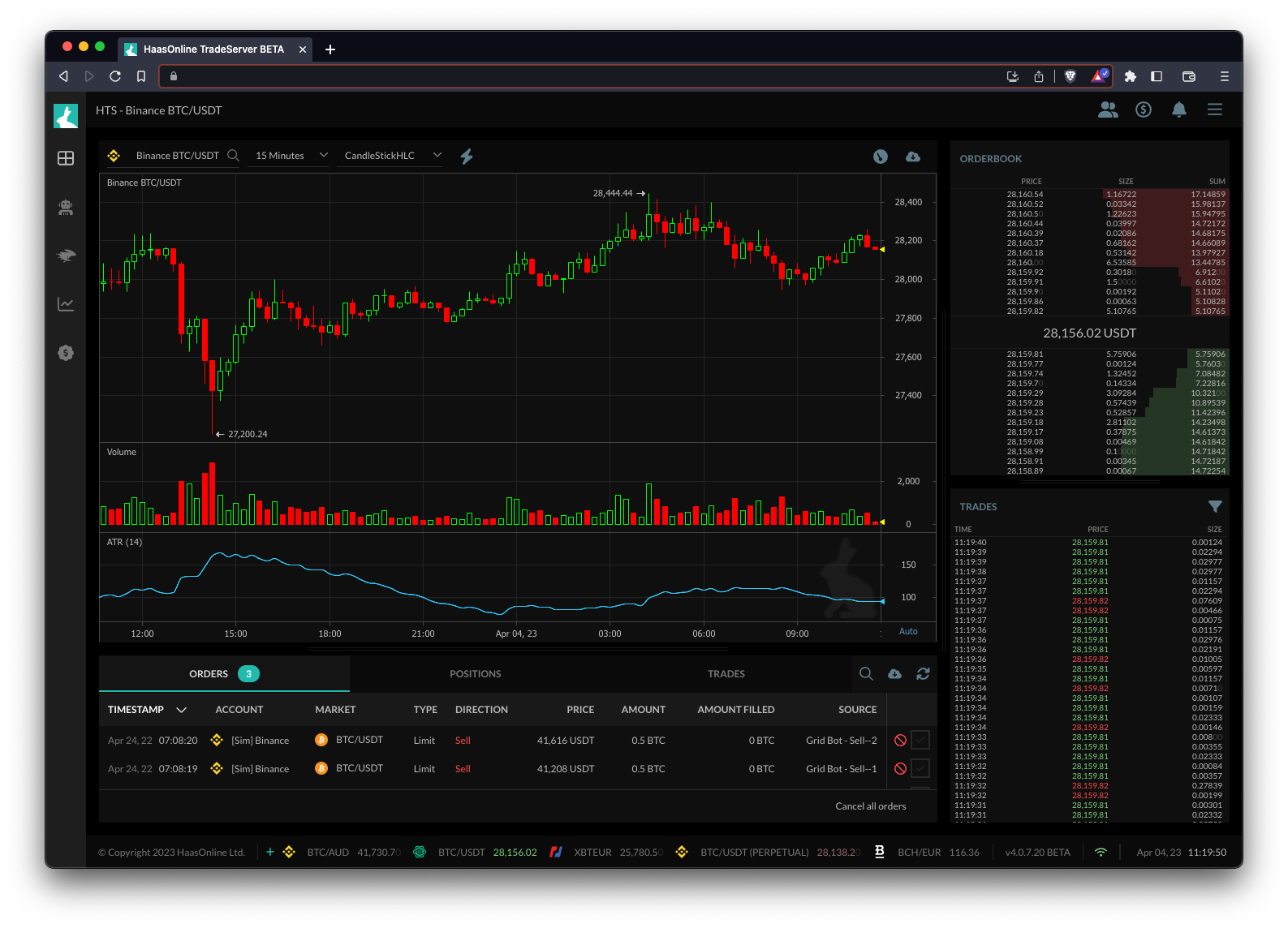

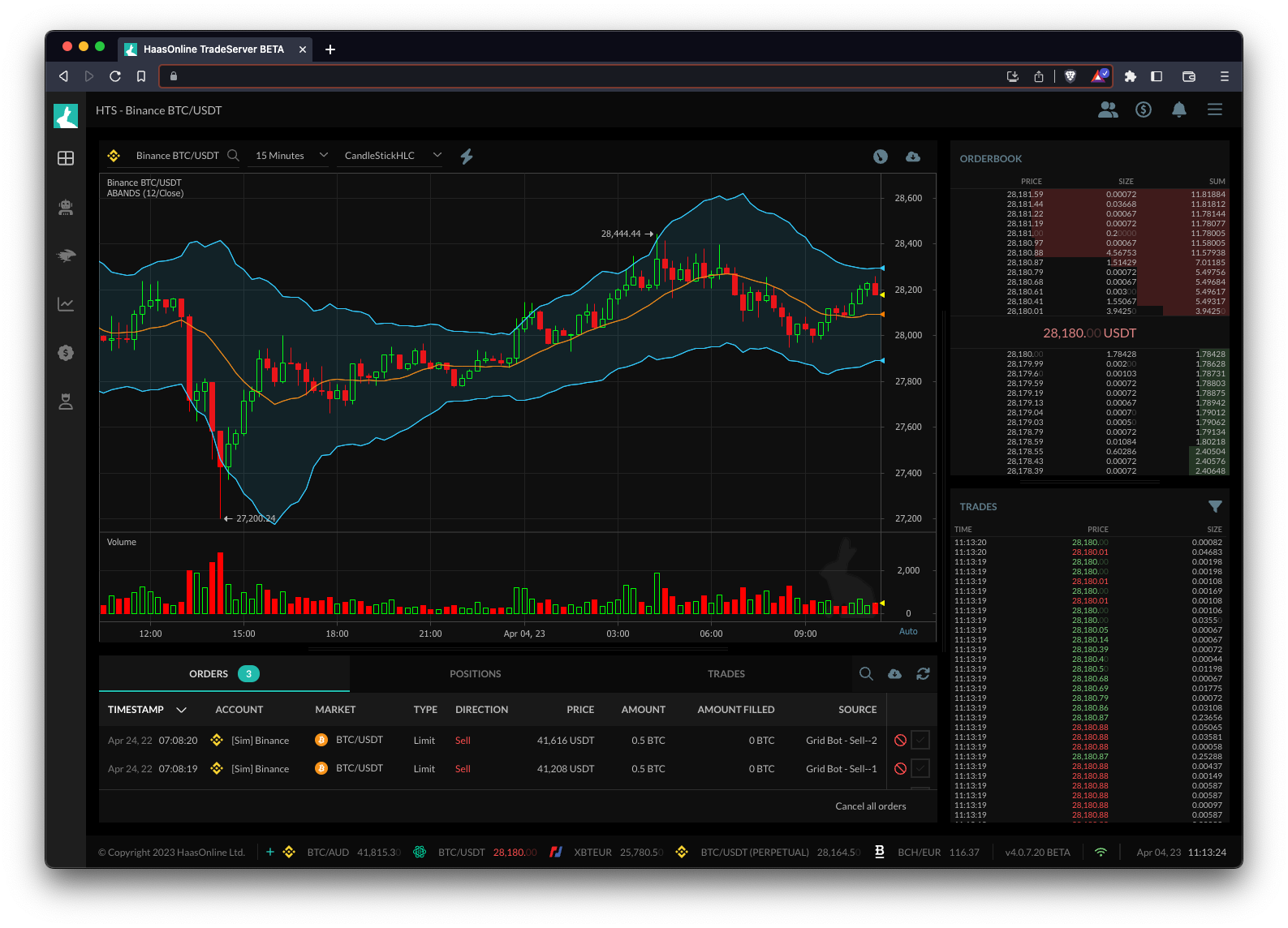

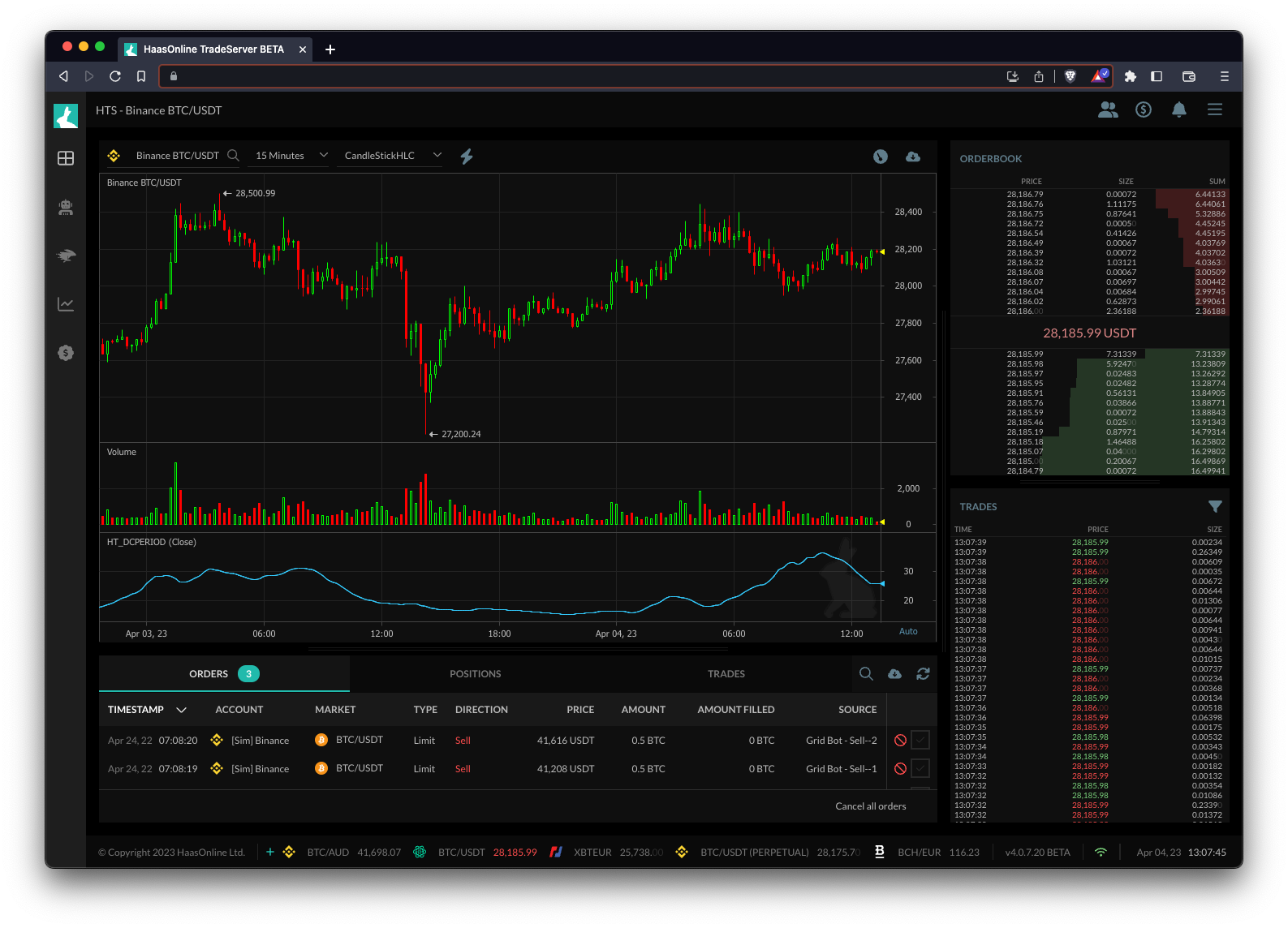

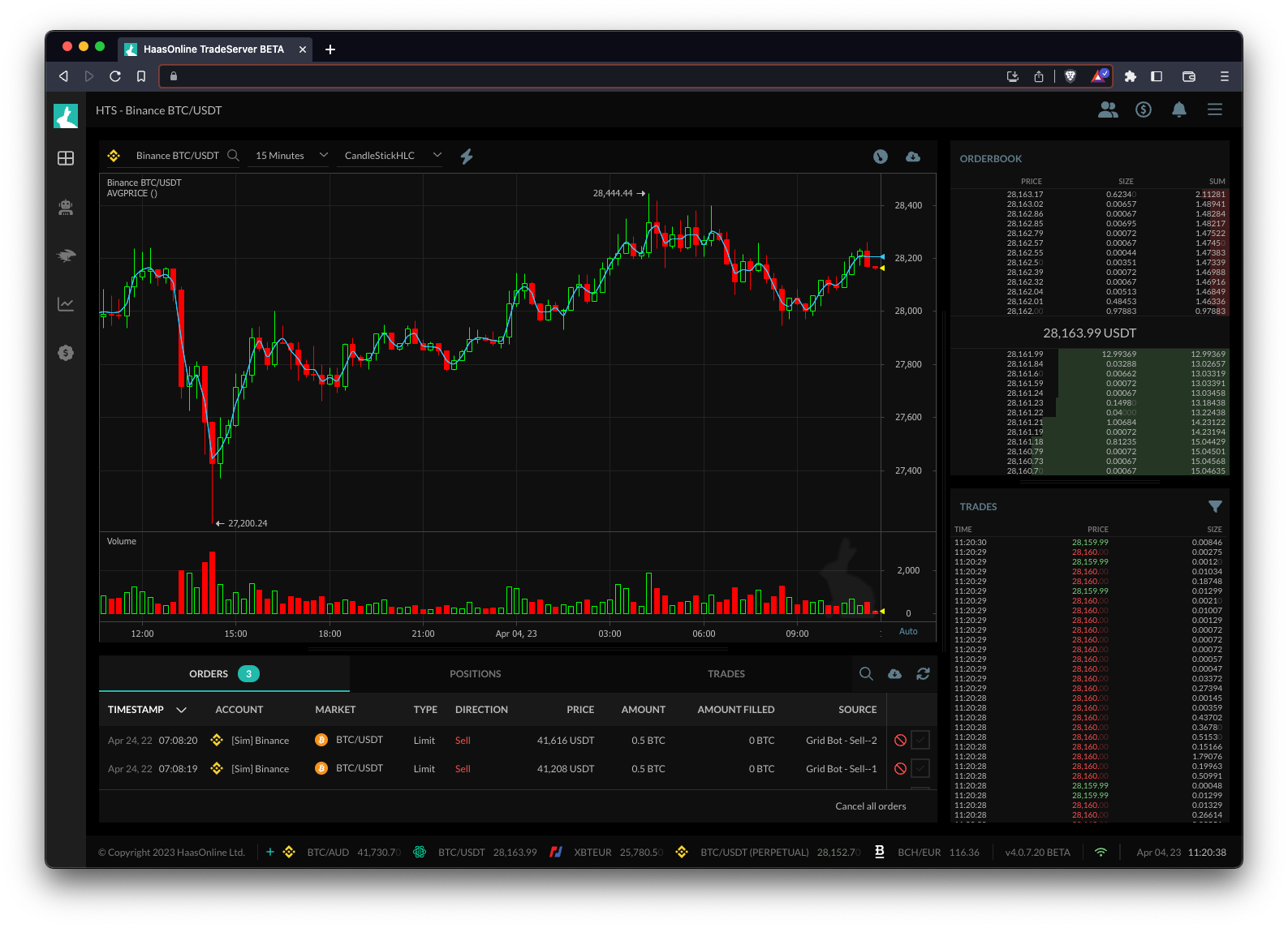

Average True Range (ATR)

The Average True Range (ATR) is a technical indicator used to measure market volatilityVolatility is a common characteristic of cryptocurrency markets, meaning that the prices of cryptocurrencies can fluctuate rapidly and unpredictably over short periods of time. This... More. It is calculated by taking the average of a security’s true range over a specified period of time. The true range is the largest of the following:

- The difference between the current high and the current low

- The absolute value of the difference between the current high and the previous close

- The absolute value of the difference between the current low and the previous close

The ATR is often used by traders to determine the appropriate stop loss and take profit levels for a trade based on the current market volatility. A higher ATR indicates higher volatility, and a lower ATR indicates lower volatility.

Trading bots like HaasOnline can use the ATR to adjust their trading strategies based on current market conditions. For example, a bot may adjust its stop loss and take profit levels based on the current ATR to ensure that it is not placing orders that are too risky or too conservative. Additionally, a bot may use the ATR to determine the size of its positions, with larger positions being taken in more volatile markets and smaller positions being taken in less volatile markets.