Thinking about using Uniswap?

Uniswap in Review

Uniswap is a completely different concept from regular crypto exchanges like a Coinbase or Binance. This is of course because it is a completely decentralized crypto exchange that runs on the EthereumEthereum is a type of cryptocurrency that is similar to Bitcoin, but with some important differences. One of the key differences is that Ethereum is... More blockchainThe blockchain is a digital ledger that records transactions in a secure and decentralized manner. Think of it like a shared spreadsheet that is constantly... More. Most crypto exchanges are centralized, meaning that there is an authority that oversees development, transfers, users, and user activity.

On Uniswap, users are able to swap tokens with nothing more than an Ethereum walletA cryptocurrency wallet is a digital wallet that is used to store, send, and receive cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. It's similar to... More. As part of the Decentralized Finance (DeFi)Decentralized finance, or DeFi, is a blockchain-based financial system that aims to offer traditional financial services without the need for intermediaries like banks or brokerages.... More, Uniswap runs on the Ethereum blockchain and supports decentralized tokenA cryptocurrency token is a digital asset that is created and managed on a blockchain network. Tokens are usually created using existing blockchain platforms, such... More swaps. It’s basically an interlock of computer programs along with unicorns (yes, unicorns) that make trades possible. Ethereum tokens can swap assets directly or lend their crypto to the liquidityLiquidity refers to the ability of an asset to be easily bought or sold without affecting its market price. In the context of cryptocurrency, it... More pools and earn fees for supplying liquidity. But we’re getting ahead of ourselves – first, let’s make things clear on what a DEX, or a decentralized exchangeA cryptocurrency exchange is an online platform that allows users to buy, sell, and trade cryptocurrencies. These exchanges serve as intermediaries between buyers and sellers,... More, is.

What Are Decentralized Exchanges?

Centralized exchanges rely on the order bookAn order book on a cryptocurrency exchange is a list of buy and sell orders for a specific cryptocurrency, showing the quantity of the cryptocurrency... More method to facilitate trades. Order trading resembles a menu: there is a list featuring orders and the prices for each of them. How liquid a market is depends on how many buy and sell orders are open at any given moment. Trades are executed by matching orders with the party on the opposite side of the order book. There is nothing wrong with using centralized exchanges, as they can offer a vast array of features, speed, and high trading volumes. But on the other hand, they do administer fees on transactions, ask for more personal details, and place a third party in the middle, which DEXes manage to avoid.

Decentralized exchanges, or DEX, are built on trustless protocols that do not need a middleman in order to facilitate and execute trades. It all comes down to blockchain technology and the way it functions. Engineers have had to reverse engineer the whole process in order to come up with a viable solution, where traders can swap assets and currencies with only an Ethereum wallet. Due to rapid innovation, Uniswap has grown into one of the most popular exchanges of the Decentralized Finance (DeFi) movement.

What Is Uniswap?

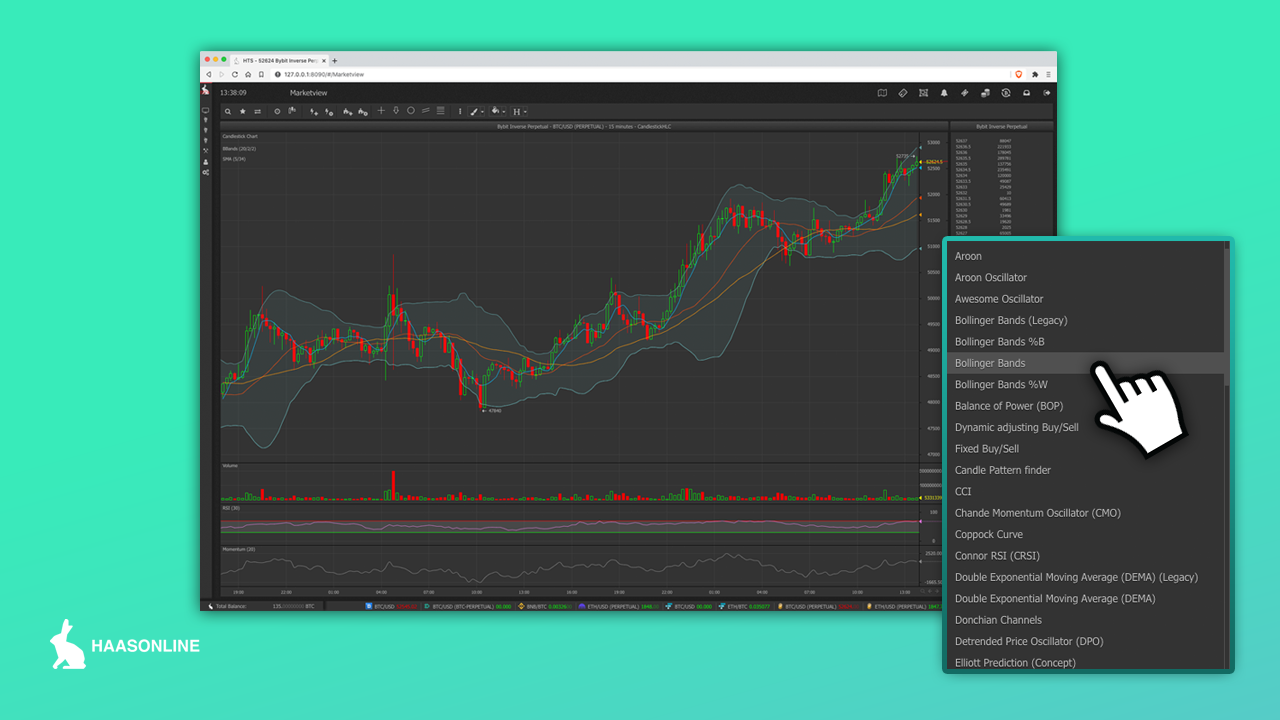

Uniswap is an open-source software that functions on Ethereum protocols featuring automated liquidity protocols. There is no need for an order book or intermediary approval in order to engage in market trades.

Putting it simply, liquidity, when referring to the market, is how active the market place is. You can think of it in terms of supply and demand. If a seller decides that they want to sell their tokens, a liquid market means that there are a lot of people that would pay their asking price, the regular price. If they try to sell the tokens on a less liquid marketplace, there might not be any buyers willing to pay the asking price, so they either have to lower the price, or wait for other buyers to come to the marketplace and hope that some of them would be willing to pay the asking price.

So, the higher the trade, the more liquidity for the marketplace. The more liquidity a market has, the more stable it is, as trades do not disrupt it by going in and out. Uniswap took the concept of “supply and demand” and modified it by taking the liquidity pools out of the hands of the centralized exchange and decentralized them by placing them into the hands of the traders themselves.

Liquidity pools are generated by liquidity providers. By making use of the system’s decentralized pricing mechanism, the platform doesn’t provide listings. Instead, users are able to swap ERC-20ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain. It defines a set of rules and functions that allow for the... More tokens with no need for an order book, which means that there are no listing fees.

The only thing that is required for a trade to go through is sufficient liquidity,

How Does Uniswap Work?

Hayden Adams is credited as the creator of the Uniswap protocol. Back in 2018, he managed to further develop Ethereum co-founder Vitalik Buterin’s technology and bypass order books by introducing an Automated Market MakerIn trading, a maker is someone who adds liquidity to the market by placing an order that is not immediately filled, but rather goes onto... More (AMM) model variant called Constant Product Market Maker.

Smart contracts are automated market makers that manage liquidity pools, which allows traders and liquidity providers to deposit tokens and digital assets in the pool. For the service to be possible, traders are subjected to a pool maintenance fee that goes to the liquidity providers based on their shares.

The liquidity providers serve as the market creators by depositing two tokens equivalent in value, or stablecoins like USDC, DAI, or USDT, to the pool. The tokens can be an ETH and an ERC-20 token or a pair of ERC-20 tokens. In exchange, the providers receive liquidity tokens, as a representation of their liquidity pool shares. The Uniswap pool has to provide consistent liquidity for trades to go through. Naturally, larger trades are more expensive than lower trades because they cause more commotion and are harder to balance out.

Uniswap v3 and Uniswap LP Tokens

Uniswap’s technology is constantly being updated and is now on its third generational iteration with Uniswap v3. The implementation of Uniswap v3 brought a whole new way of processing capital, which has made it a lot more efficient. Uniswap v3 LP positions are unique since everyone can customize the price ranges that they supportIn technical analysis, a support line is a price level at which demand for an asset is thought to be strong enough to prevent the... More, meaning that their positions are non-fungible and each position is represented by an NFT token.

Uniswap v2 tokens can be deposited as collateralCollateral is an asset that a trader pledges to a lender to secure a loan or margin trading position. In the context of crypto trading,... More through Aave as well as MakerDAO because their position cannot be customized. So what they do is provide general liquidity across the pool. This way, most AMMs are capital-inefficient because most of the assets that they store aren’t being utilized. Uniswap v3 employs those dormant assets in order to improve pool liquidity when needed. Another interesting piece of programming is that liquidity providers are able to customize the price range which they provide liquidity for, which allows for a more liquid pool in the places where trades are being executed.

How to Use Uniswap

Getting started on Uniswap isn’t difficult. Users just need an ERC-20 wallet, such as Coinbase wallet, Portis, WalletConnect, MetaMask, or Fortmatic, to store Ether on it. This way, they can cover gasGas is a unit used on the Ethereum blockchain to measure the computational effort required to execute transactions and smart contracts. It's the fee paid... More fees and participate in trades. The gas fees are calculated based on the network traffic and the speed at which trades are processed and executed by miners. Most of the time, users will be given three payment speed options, ranging from slow to fast. Naturally, quicker processing comes at higher gas fees.

Does Uniswap Make a Profit?

It might come as a surprise, but all Uniswap fees go to the liquidity providers, as the platform is run by decentralized protocols. Transaction fees for liquidity providers are 0.3% on a per-trade basis. The fees are added to the liquidity pool automatically, but providers do have the option to transfer them to their balance accounts if they please.

A Few Words Before You Go…

Uniswap took the industry a step further because it welcomes virtually everyone who has an Ethereum wallet to participate in trades without a central governing party. The problem is that the miningCrypto mining is the process of validating transactions and creating new units of cryptocurrency through solving complex cryptographic puzzles using computer hardware. Anyone with access... More craze on Ethereum 1.0 is killing the planet’s environment through wasteful energy spending. In any case, once Ethereum 2.0 and POS replaces POW for good, Uniswap will probably be launched to new unprecedented heights.