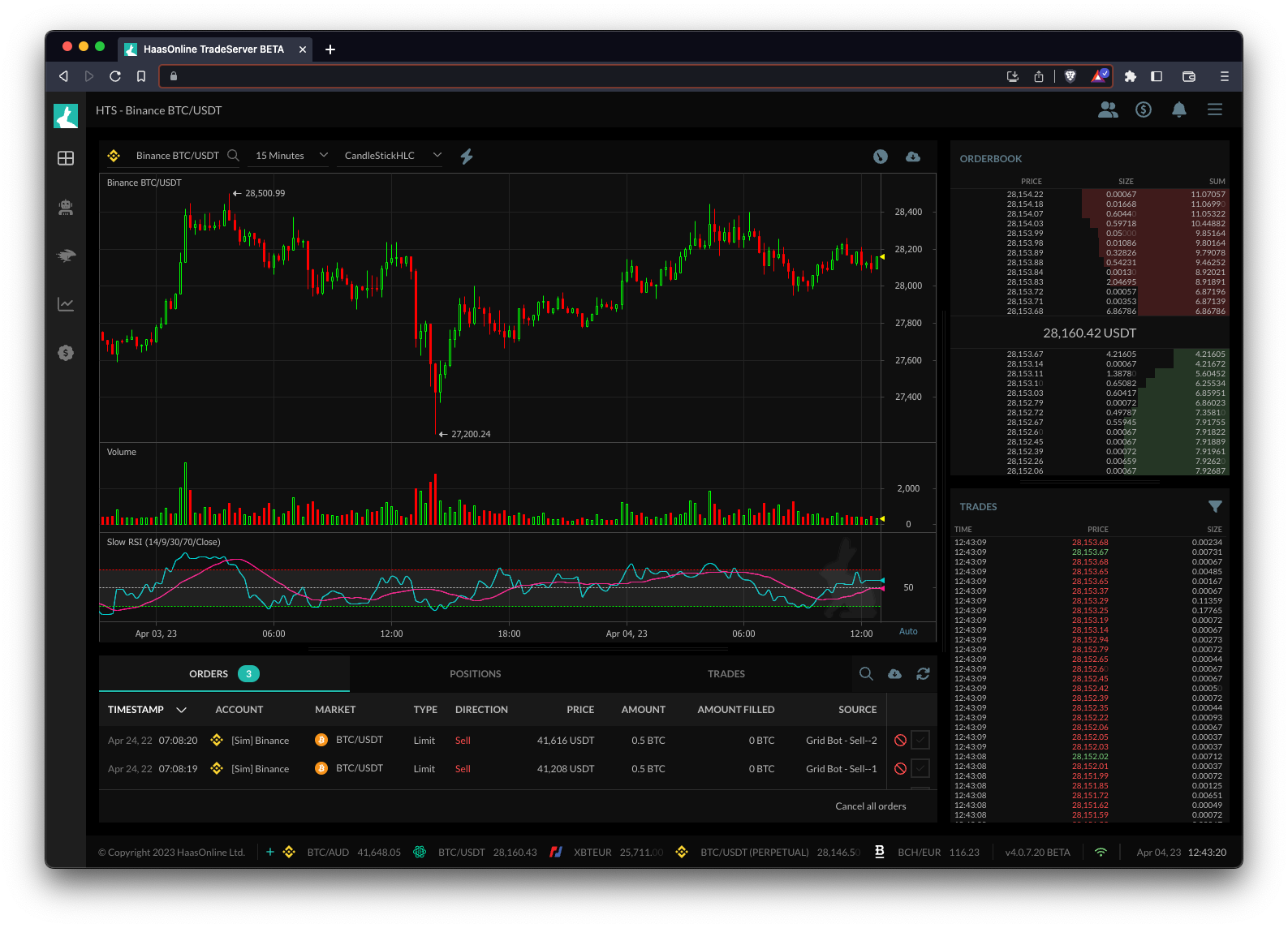

Slow RSI

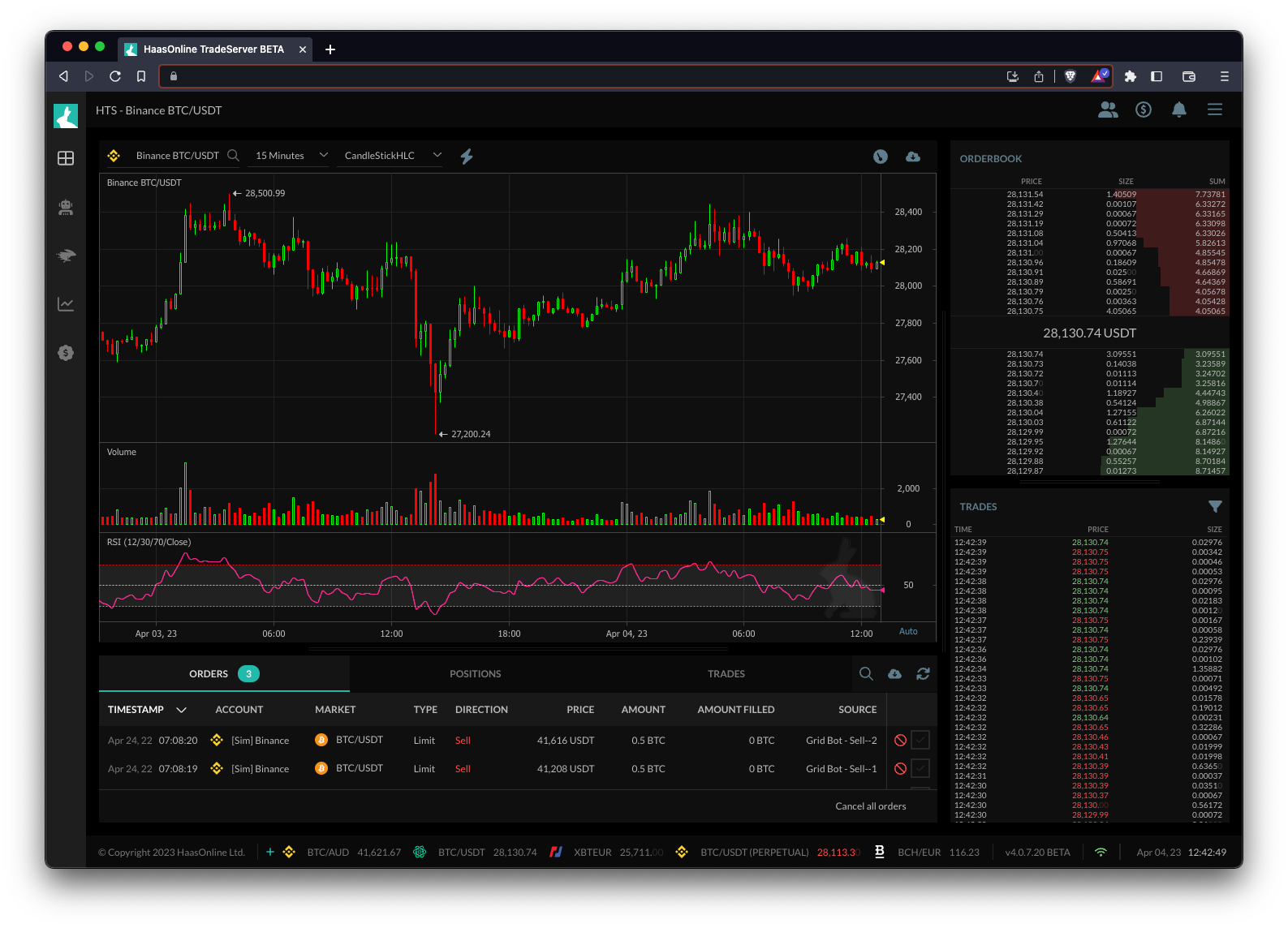

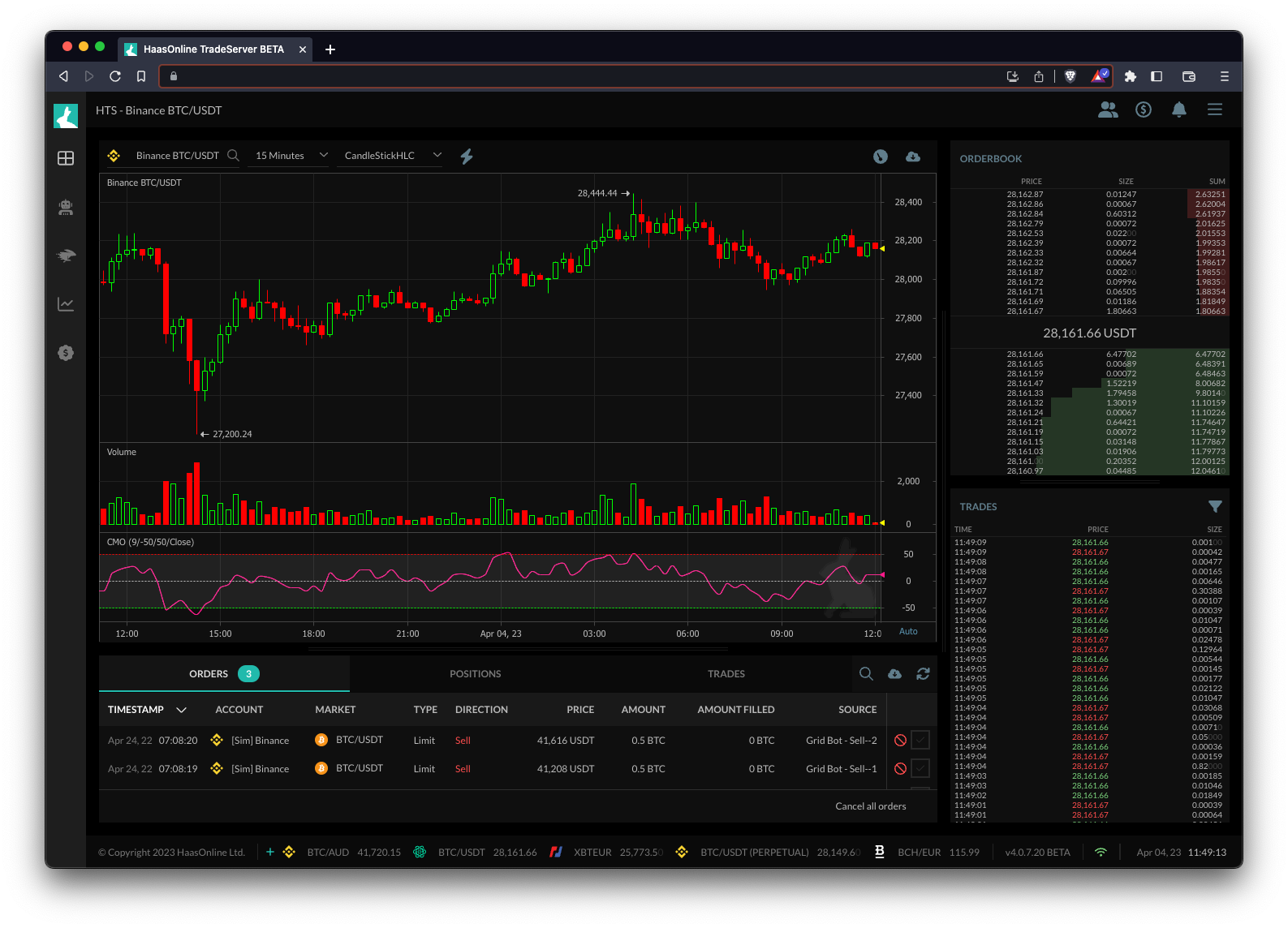

The Slow Stochastic indicator measures the momentum of an asset’s price by comparing the closing price to the range of prices over a specified period. It is a bounded indicator that fluctuates between 0 and 100. When the indicator rises above 80, it is considered overbought, while readings below 20 indicate oversold conditions.

The Slow Stochastic indicator can be used with trading bots like HaasOnline to identify potential entry and exit points based on overbought and oversold conditions. When the indicator reaches overbought levels, traders may look to sell, while oversold readings can signal a buying opportunity. Traders can also use the indicator in conjunction with other technical analysis tools to confirm potential trades.