Choppiness Index

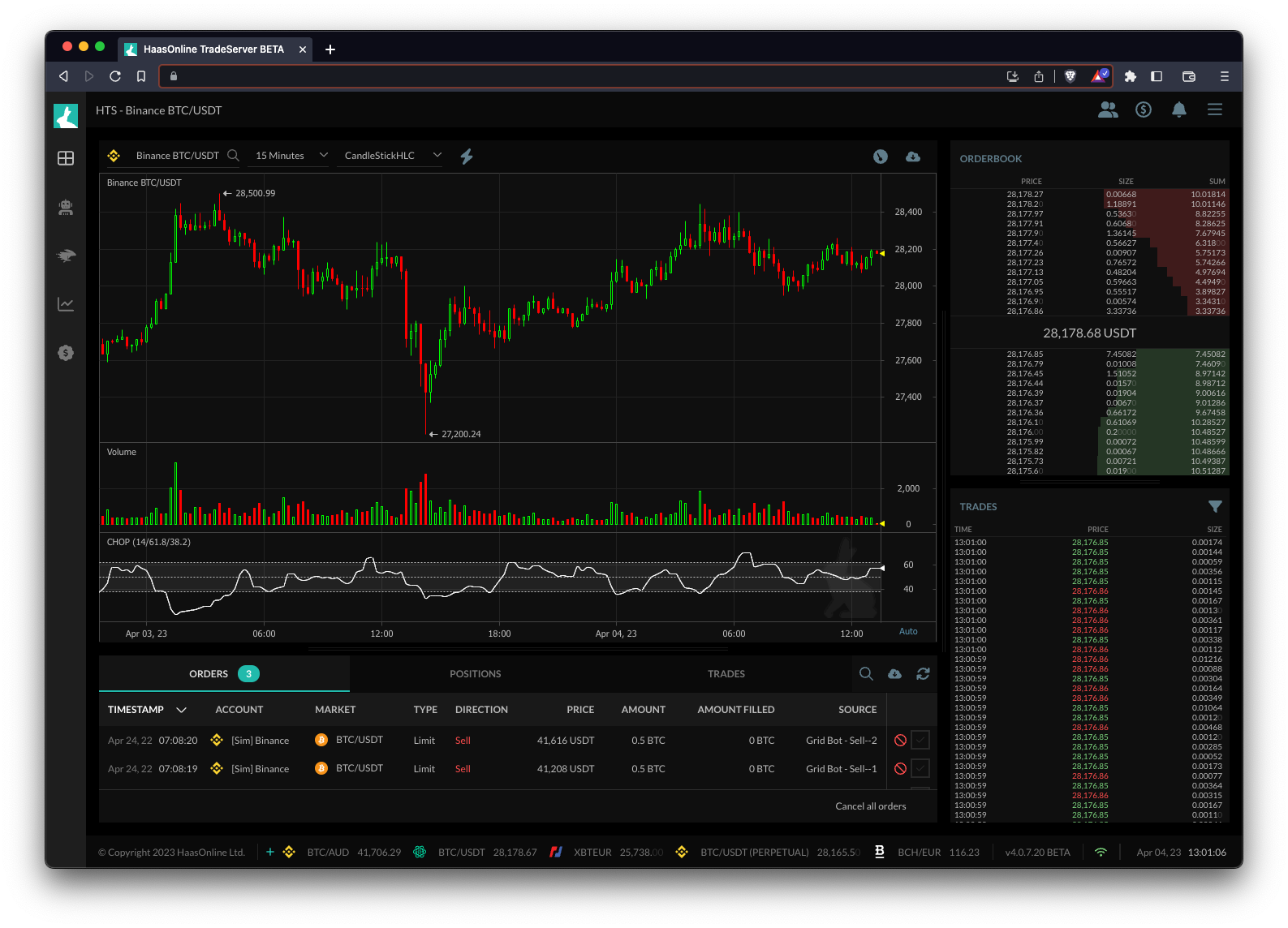

The Choppiness IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... is a technical indicator used to determine whether the market is trending or ranging. It was created by Australian commodity trader E.W. Dreiss and is based on the idea that markets go through cycles of high and low volatilityVolatility is a common characteristic of cryptocurrency markets, meaning that the prices of cryptocurrencies can fluctuate rapidly and unpredictably over short periods of time. This.... The Choppiness Index calculates the ratio of the range between the high and low prices over a certain period to the average true range over the same period, and then multiplies this value by 100 to get a percentage.

The Choppiness Index ranges from 0 to 100, with low values indicating a trend and high values indicating a range-bound market. A reading below 30 suggests a trending market, while a reading above 60 suggests a ranging market. Traders can use the Choppiness Index to identify when to enter or exit trades, depending on whether the market is trending or ranging.

In HaasOnline trading bot, the Choppiness Index can be used in combination with other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and... to create trading strategies. Traders can set up their bots to enter a trade when the Choppiness Index reaches a certain level, and exit the trade when the index reaches another level. Additionally, HaasOnline allows traders to backtest their Choppiness Index-based trading strategies using historical data to see how they would have performed in real market conditions.