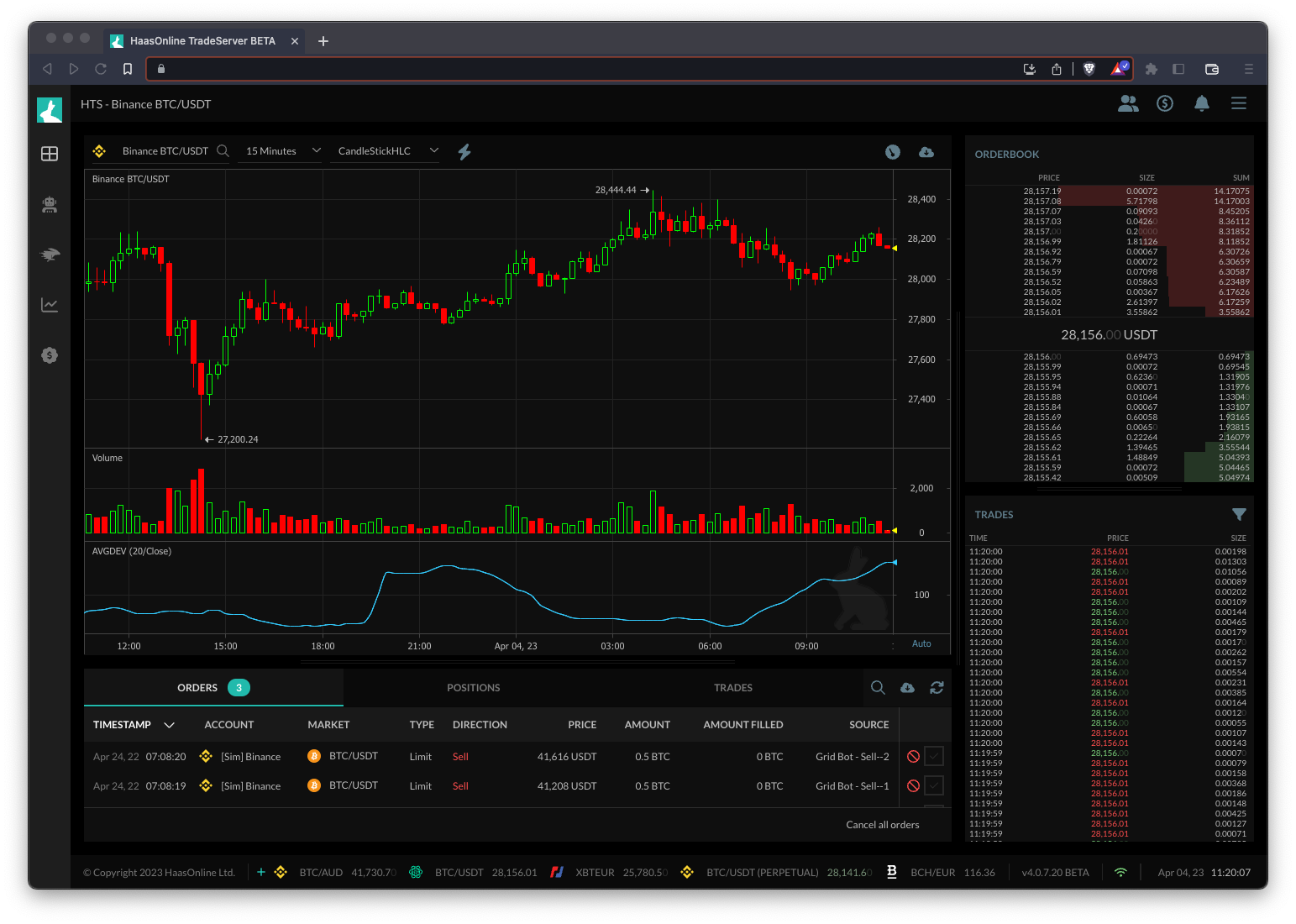

Average Deviation (AVGDEV)

The Average Deviation (AVD) indicator is a technical analysis tool used to identify the volatilityVolatility is a common characteristic of cryptocurrency markets, meaning that the prices of cryptocurrencies can fluctuate rapidly and unpredictably over short periods of time. This... of a particular asset. The AVD is calculated by taking the moving average of the absolute deviation from the asset’s average price.

Traders often use the AVD indicator to help identify potential changes in market trends or volatility. When the AVD is increasing, it can indicate that the asset is becoming more volatile. Conversely, when the AVD is decreasing, it can indicate that the asset’s volatility is decreasing.

The AVD indicator is often used in conjunction with other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and..., such as moving averages or trend lines, to help identify potential entry and exit points for trades. By analyzing the AVD in combination with other technical indicators, traders can gain a better understanding of market trends and potentially improve their trading strategies.

In HaasOnline, traders can use the AVD indicator in their automated trading strategies by incorporating it into their trading bots. By setting specific parameters and conditions for the AVD indicator, traders can create customized trading strategies that take advantage of market volatility and trend changes.

Overall, the Average Deviation indicator is a useful tool for traders looking to identify potential changes in market trends and volatility. When used in combination with other technical indicators, it can help traders create more informed and successful trading strategies.