How to set up your crypto arbitrage bot with HaasOnline TradeServer

What is a crypto arbitrage bot?

A crypto arbitrage bot is a tool you will use that executes a series of predefined instructions based on your user-defined settings. Our custom and trade bots can vary widely in performance and complexity, but the basic premise is the same — the bots will try to take advantage of price spread discrepancies between crypto pairs on select exchanges where the opportunity has been identified.

We’ve previously written about crypto arbitrage in a prior published article, which will give you a much greater detail into the background of this proven trading strategy. https://www.youtube.com/embed/Q7gqB8HT_Eg?feature=oembed&enablejsapi=1&origin=https://www.haasonline.com

What are the different types of crypto arbitrage bots?

Inter-exchange arbitrage

Our crypto arbitrageArbitrage is a trading strategy that involves taking advantage of price differences for the same asset on different exchanges. For example, if Bitcoin is trading... bots typically take advantage of market discrepancies between crypto pairs on different exchanges. An oversimplified example of this strategy would be buying BitcoinBitcoin is like a digital treasure that you can use to buy things online. It's like having a secret code that only you know, and... ($BTC) from Bittrex and selling it for profit on Binance. The basic arbitrage strategy generates profits from price differences between the exchanges that have been identified to have profitable arbitrage paths. Historically, these inefficiencies have proven to be significant when identified and executed on quickly.

Intra-exchange or triangular arbitrage

There’s another variation of crypto arbitraging, which is it’s riskier cousin commonly known as triangular arbitraging. With this strategy you would buy three different digital assets on the same exchangeA cryptocurrency exchange is an online platform that allows users to buy, sell, and trade cryptocurrencies. These exchanges serve as intermediaries between buyers and sellers,.... For example you might buy 0.5 BTC, exchange that for 50 ETH, and then finally exchange that for USDT and net a profit. There’s quite a lot more moving parts, however when designed, tested, and executed properly has the potential to generate profitable trades.

Configuring your bots to execute crypto arbitrage

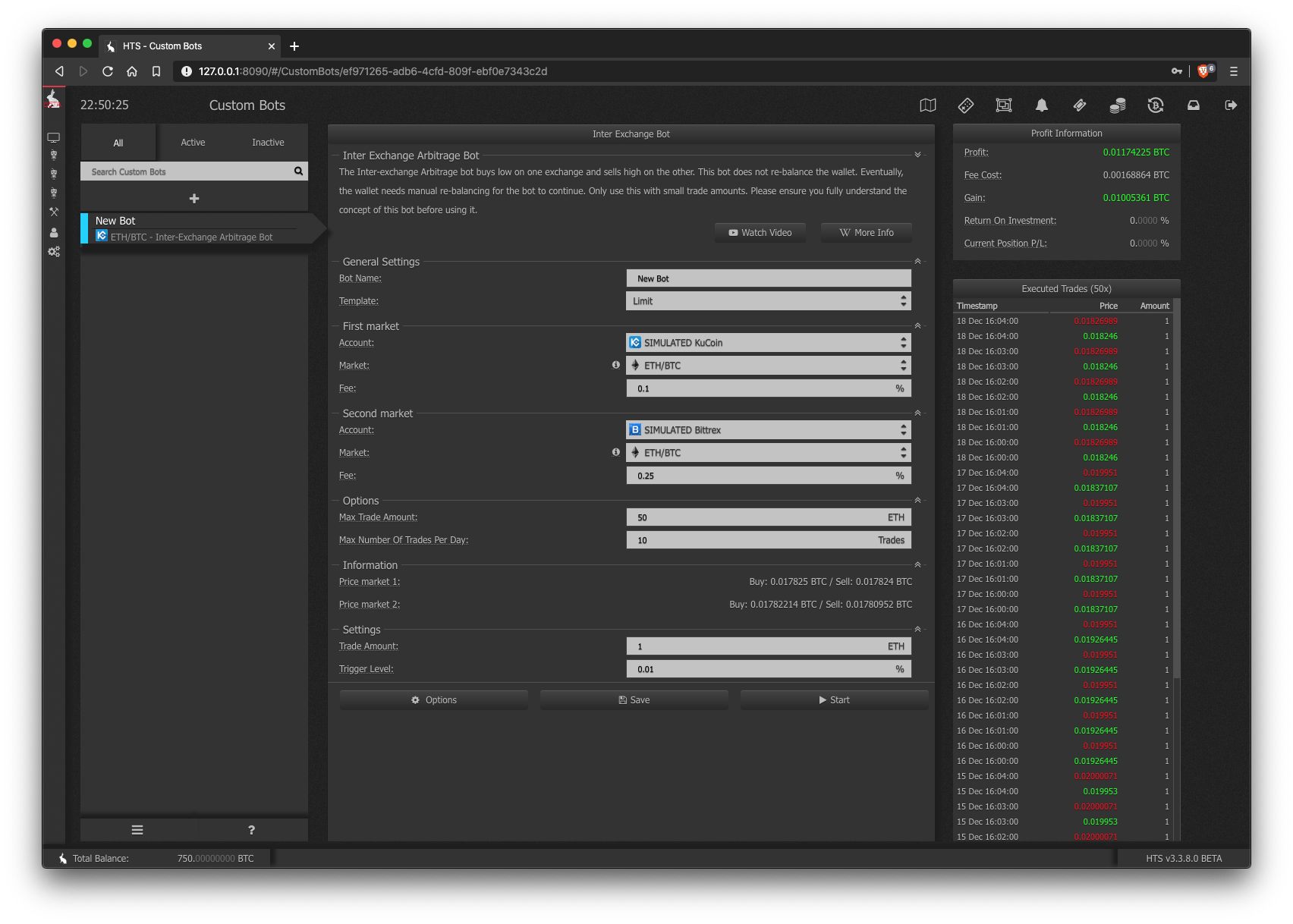

Using our legacy crypto arbitrage bots

Our legacy trading bot framework is a great choice if you’re looking for the simplicity of having a pre-defined configurable setting. This is a great way to start to familizare yourself with our crypto arbitrage bot as you can backtest with historical data or deploy it with all your selected exchanges in real-time with simulated trading.

- Login into your HaasOnline Trade Server instance

- Navigate to “Custom Bots” from the left-hand menu

- Click on the “+” icon to add a new trade bot

- Select “Inter-Exchange Arbitrage Bot” from the drop menu

- Give it a unique name

- Select the simulated or live exchange to use with this arbitrage bot

- Click “Add Bot”

- Select your desired order type

- Configure your primary market first

- Configure your secondary market

- Define your arbitrage options and trade setting

- Click “Save”

- You’ve created your very own crypto arbitrage bot. Now use the options section to backtest and run simulated trades and fully test with your current settings.

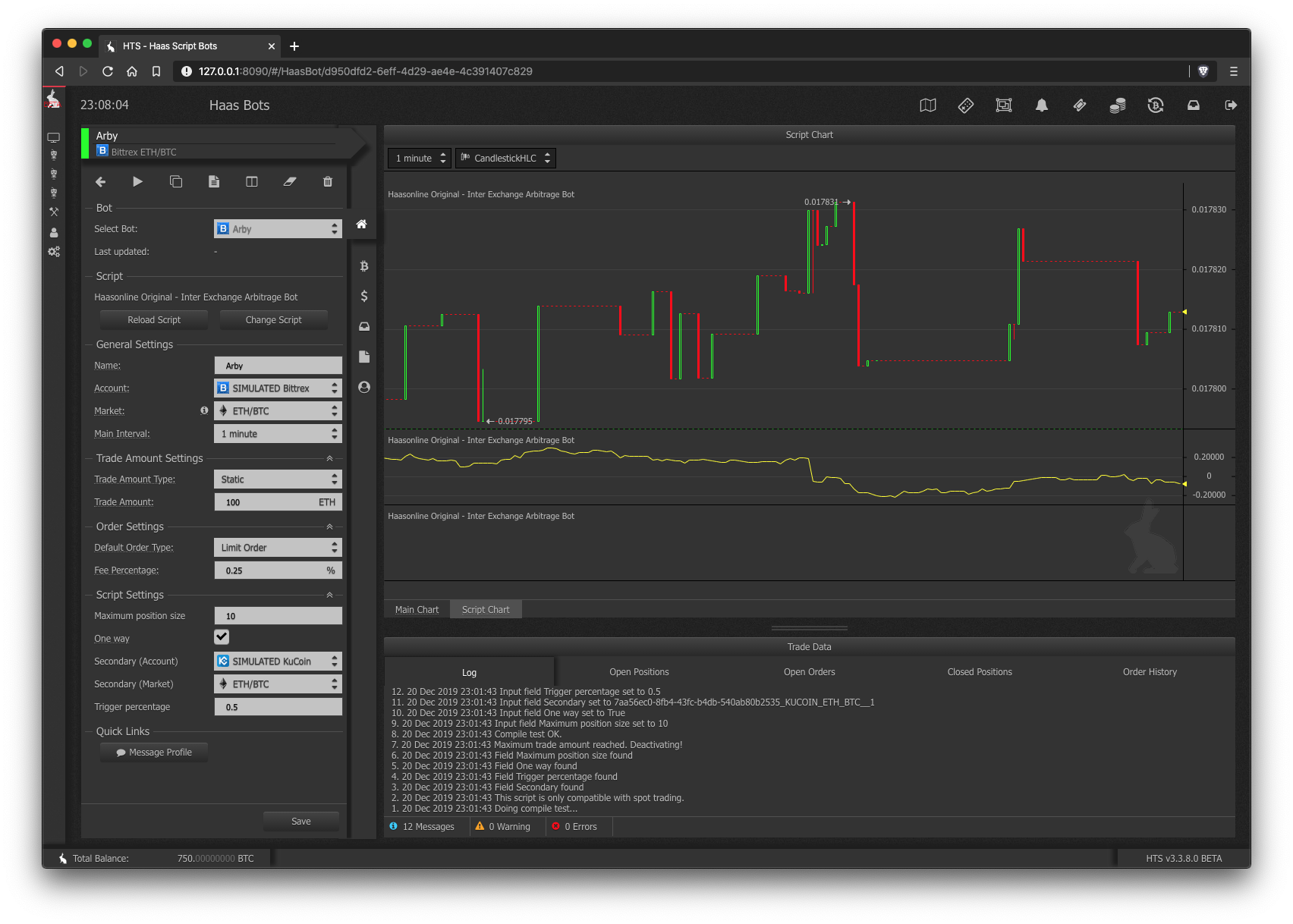

Using our next generation crypto arbitrage bots running on HaasScript

Since our updated trading scripts are built with HaasScript you can not only view the code for the bot, but also modify everything within it. This means you can add extra validation, triggers, delay, alerts, and much more.

- Login into your HaasOnline Trade Server instance

- Navigate to “Haas Bots” from the left-hand menu

- Click on the “Add bot” button to add a new trade bot

- Give your trading bot a unique name

- Search “Arbitrage” in the script library

- Select the “Original HaasOnline Arbitrage Bot”

- Similar to our legacy arbitrage bot, you will need to configure your primary market and desired crypto pair

- You will need to define your interval, which is the time in-between chart price checks the script will use

- Enter the amount you want to use with this trade bot

- Select your specific order type

- Define a fee percentage to use with backtests and simulation

- Set the max position you want your arbitrage bot to use

- Specify whether this bot should only execute one way

- As always backtest and test your arbitrage bot with simulated trading to iron out any bugs

- If you want to modify the script head over to the “Script Editor” in the left-hand menu, make your changes, and retest.

Risk to consider and avoid when possible

Settlement times

It is important to know the average settlement time for each of the selected exchanges you are using with your arbitrage strategy. This will help with execution of your identified opportunities, rebalance your exchange wallets, and help buffer for when markets have higher than normal traffic.

Fees

Fees can quickly eat up your profit margins and should be one of the first things taken into account while developing a successful crypto arbitrage strategy. These fees should include withdrawal, network, makerIn trading, a maker is someone who adds liquidity to the market by placing an order that is not immediately filled, but rather goes onto..., takerIn cryptocurrency trading, a taker is a trader who places an order that is immediately executed against an existing order on the order book. Takers..., and any other fees the exchange may impose. If your active strategy does not take into account fees, you will quickly degrade the performance of your arbitrage bot.

Market liquidity

If you’ve identified an opportunity and the crypto pair is on an exchange with low liquidityLiquidity refers to the ability of an asset to be easily bought or sold without affecting its market price. In the context of cryptocurrency, it..., you won’t be able to enter or exit positions fast enough to take advantage of the spread. It’s important to thoroughly vet your active exchanges. Use could also create a HaasScript powered arbitrage bot and add in extra checks for exchange volumeVolume refers to the total amount of a cryptocurrency that has been traded within a specific time period, usually 24 hours. It is a key... or other insurances.

Broadband connectivity issues

More often than not your residential broadband connections will experience intermittent outages or spikes in latencyLatency is the delay between when an order is placed and when it is executed on a trading platform. Lower latency is important when making.... This is why we recommend using a virtual private server that is geolocated as close as possible to the known locations of your exchanges.

Hardware or software issues

Using hardware that’s not meant to be put through constant stress and combined with poor conditions like heating or running several high-intensity applications in parallel will drastically degrade our automated trading engines ability to perform at peak performance.

Final thoughts on using arbitraging strategies

While this trading strategy has been popular and reliable with traditional markets like Forex, it’s still extremely risky with cryptocurrencyCryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Cryptocurrencies use decentralized technology called blockchain... due to a combination of the risks mentioned above. Make sure you’ve done your due diligence and understand how this strategy works as well as understand the intricacies of how HaasOnline Trade Server will execute your crypto arbitrage strategy.