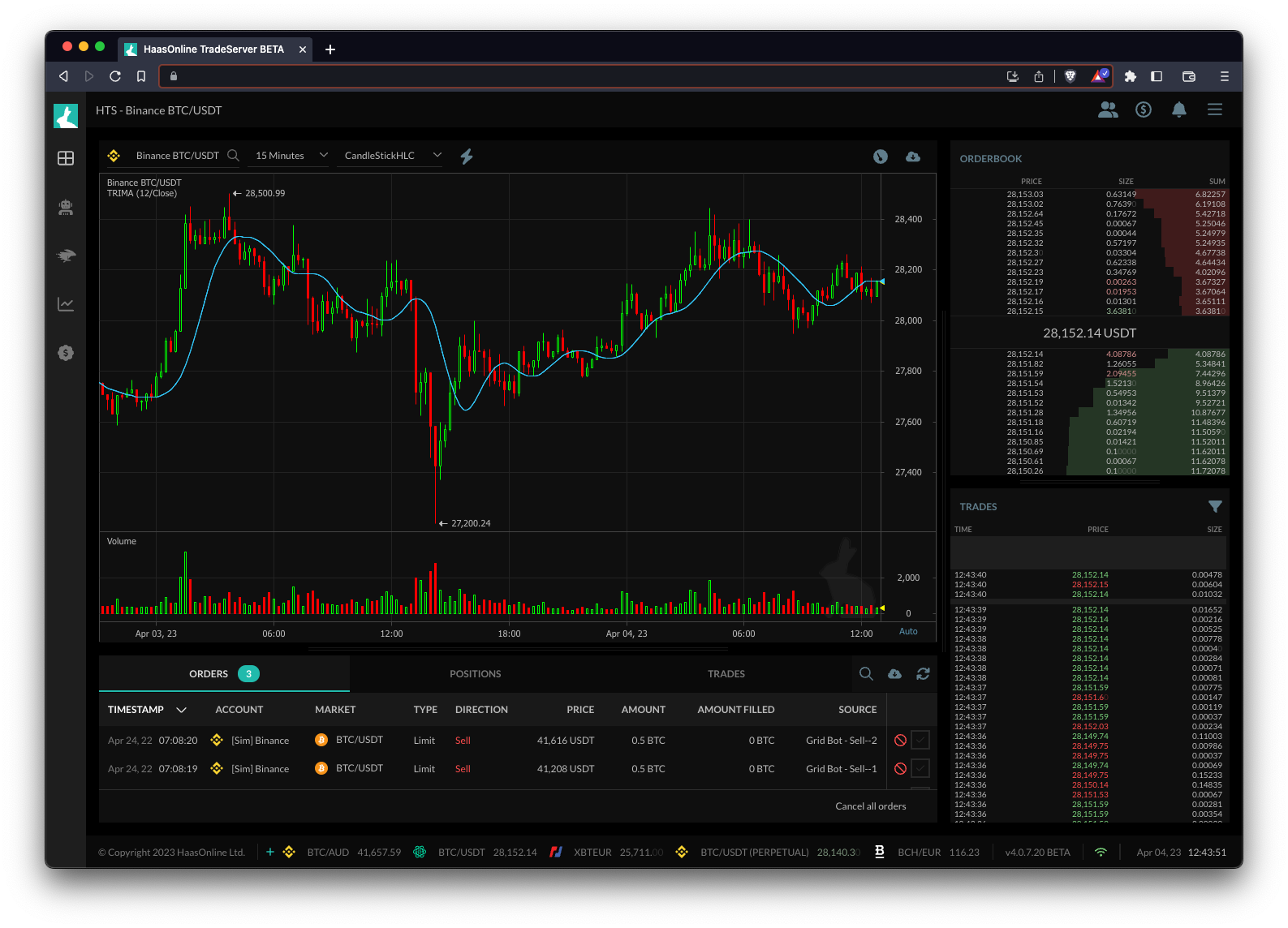

Triangular Moving Average (TRIMA)

The Triangular Moving Average (TRIMA) is a technical indicator that smooths out price actionAs a trader, price action refers to the movement of the price of a cryptocurrency over time. It's the study of how the price changes... More over a specified period of time. It is similar to the Simple Moving Average (SMA) and Exponential Moving Average (EMA), but the weights are centered on the midpoint of the period rather than at the beginning or end. The TRIMA is used to identify the trend and provide buy/sell signals based on crossovers with other moving averages.

In trading bots like HaasOnline, the TRIMA can be used as one of the indicators in a trading strategy. For example, a strategy could involve buying when the price crosses above the TRIMA and selling when the price crosses below the TRIMA. The TRIMA can also be used in conjunction with other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and... More, such as the Relative Strength IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (RSI) or Moving Average Convergence Divergence (MACD), to create a more robust trading strategy. HaasOnline provides the ability to backtest trading strategies using historical data and adjust parameters, including the period used for the TRIMA calculation, to optimize performance.