Tillson Moving Average

The Tillson Moving Average (TMA) is a technical analysis indicator used to smooth out price fluctuations and highlight market trends. It is calculated using a combination of exponential moving averages (EMA) and the traditional simple moving average (SMA). The TMA is designed to reduce lag and filter out market noise while providing a more accurate representation of price movements.

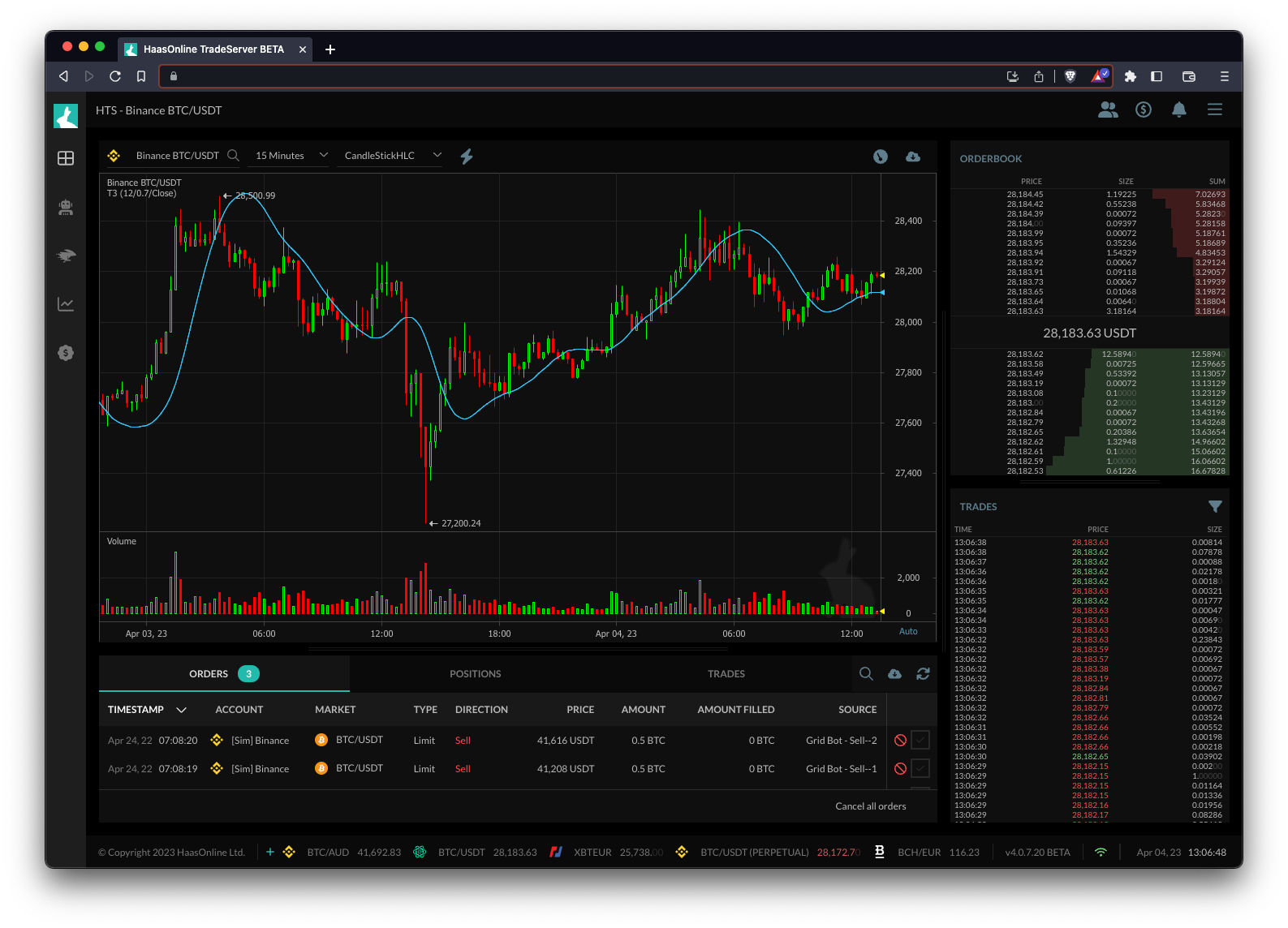

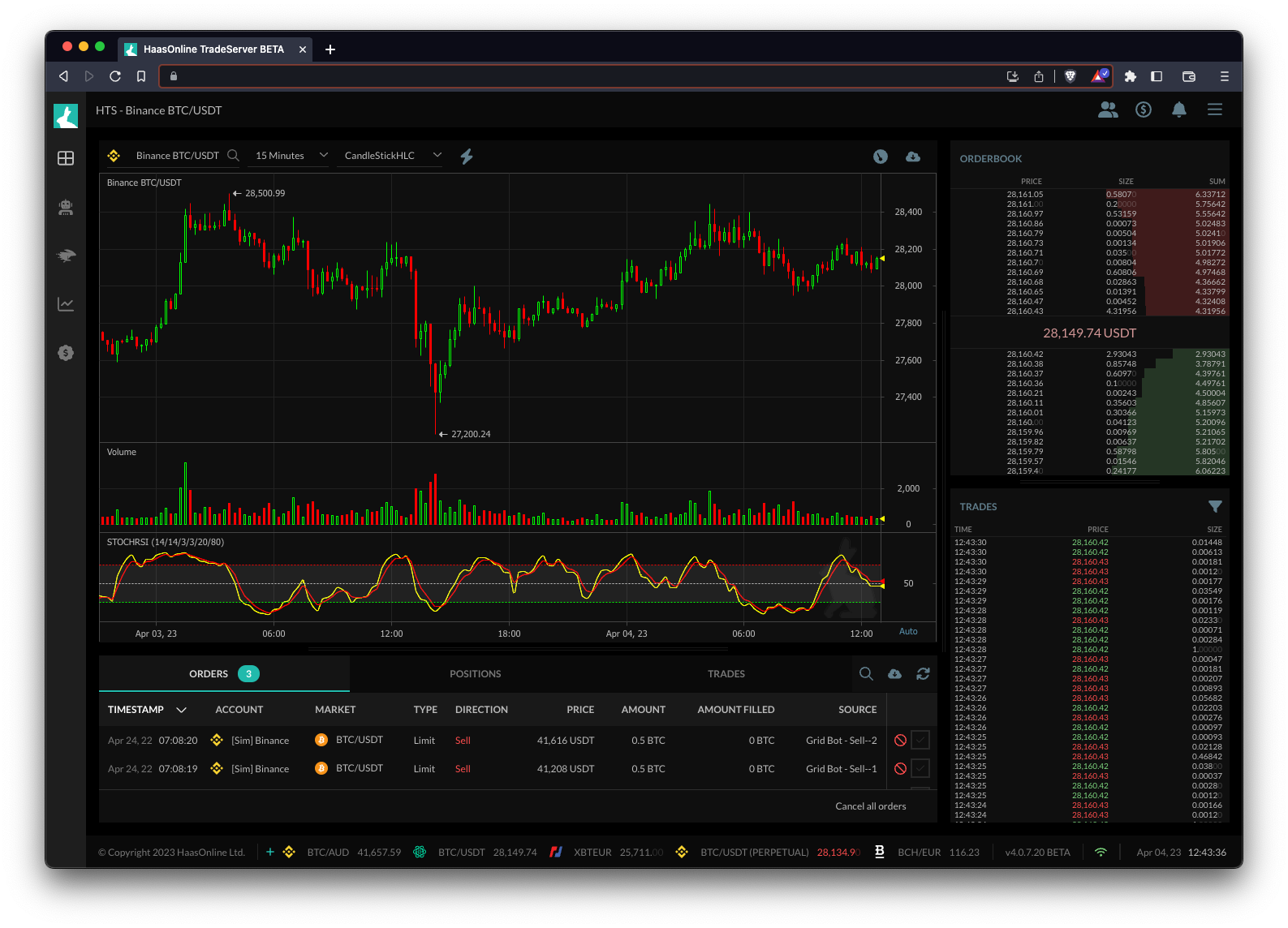

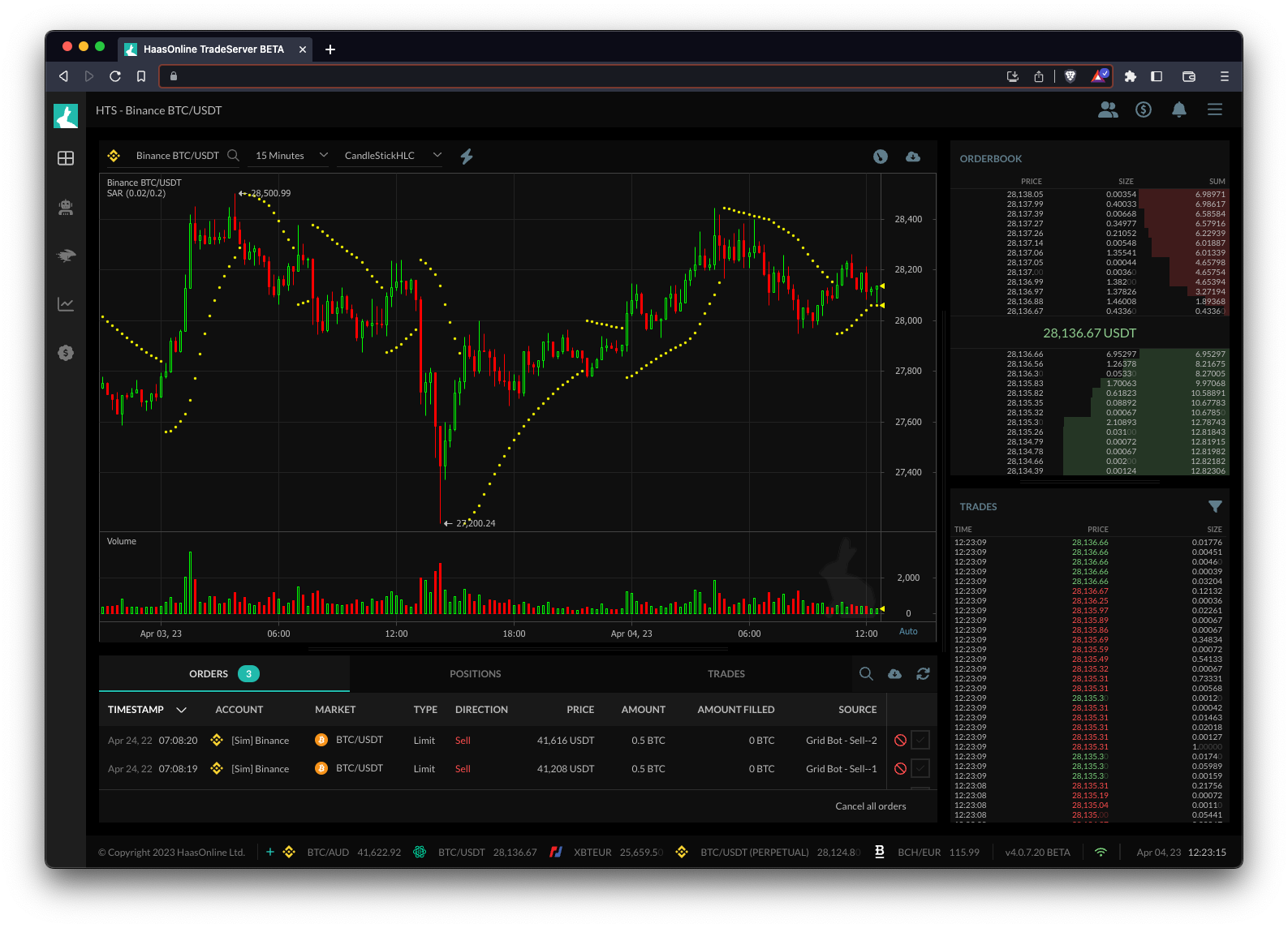

In trading bots like HaasOnline, the TMA can be used as a standalone indicator or in conjunction with other indicators to create trading strategies. For example, a trader may use the TMA as a trend-following indicator to identify bullish or bearish market trends. When the TMA is sloping upward, it may indicate a bullish trend, while a downward slope may indicate a bearish trend. The TMA can also be used in combination with other indicators, such as the Relative Strength IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (RSI) or the Moving Average Convergence Divergence (MACD), to create more complex trading strategies. Overall, the TMA can help traders make more informed trading decisions and potentially increase their profitability.