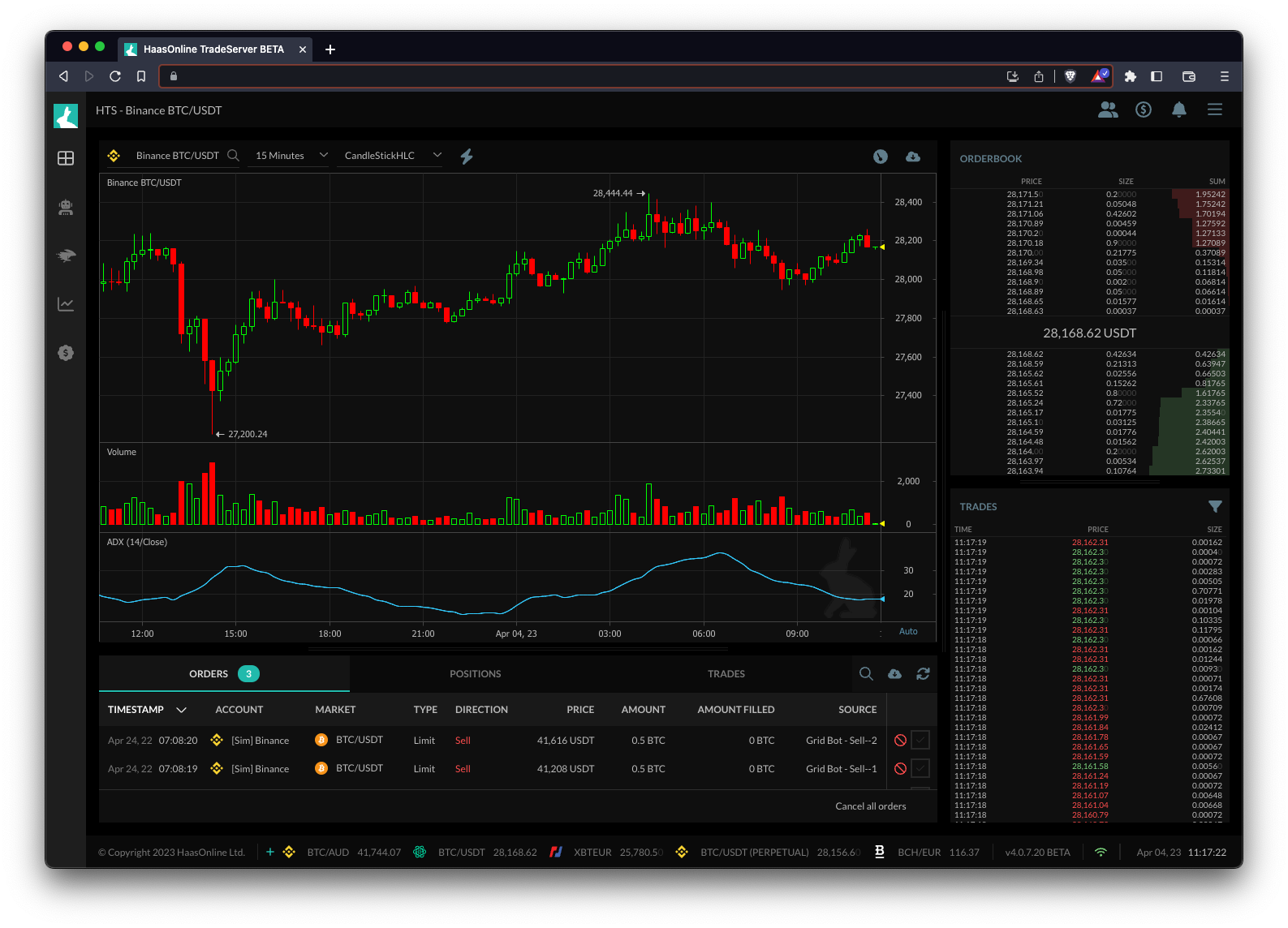

Average Directional Index (ADX)

The Average Directional IndexAn index related to cryptocurrency trading is a tool that is used to track the performance of a group of cryptocurrencies. It is designed to... More (ADX) is a technical indicator that is used to measure the strength of a trend. The ADX is calculated by taking the difference between two other indicators, the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI), and then dividing that difference by the sum of the two indicators. The resulting value is plotted as a line on the chart.

The ADX is used by traders to determine the strength of a trend and to identify when a trend is starting or ending. A high ADX reading indicates a strong trend, while a low ADX reading indicates a weak trend. Traders can use the ADX to confirm other technical indicatorsTechnical indicators are mathematical calculations based on the price and/or volume of an asset. They are used to help traders identify market trends, momentum, and... More and to make informed trading decisions.

Trading bots like Haasonline can use the ADX as part of their strategies by incorporating it into their trading algorithms. The bot can be programmed to enter or exit a trade based on specific ADX values, such as entering a long position when the ADX is above a certain level and exiting when the ADX falls below a certain level. This can help the bot make more informed and profitable trades.